HIGHLIGHTS

- US equities improve by 0.90% led by small caps.

- A strong September.

- Proposed tax reform helps move markets higher.

- Yellen comments on interest rates.

PERFORMANCE

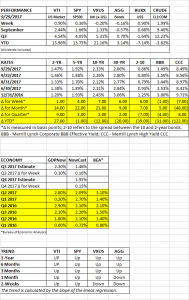

US equities improved by 0.90%, helped by a surge in small-caps, +2.7% on the week. International equities fell by 0.20%. Bonds fell another 0.16% on slightly higher interest rates, the dollar was up by 0.90% and crude was up 1.99%.

September turned out to be a strong month. The Dow was up 2.08% while the average for September has been a 1.09% loss, according to the Bespoke Investment Group. But small-caps were the story in September, the Russell 2000 was up 6.09%, helped by a stronger dollar and the possibility of tax reform (see below). Financials also were strong, the KBE was up 9.08% and energy advanced by 8.75% (XLF). In fact, September looked a lot like the post-election rally.

For the first 9 months of the year, US equities are up about 14%, international equities by 21% and bonds by 3%.

TAX REFORM

Markets advanced on excitement over tax reform, whether the proposal ever makes it into law is another matter.

On the individual side, there would now be three brackets instead of seven, the highest rate would fall from 39.6% to 35%, business income would “pass through” at a 25% rate, the estate tax would be eliminated, and the deduction for state and local taxes would be taken away.

An obvious problem is that everyone will now try to move individual income to “pass-through” entities (LLCs and Sub-S corporations) in order to take advantage of the lower 25% rate for high-income earners. If the idea is to simplify the tax code, this provision does the opposite.

And taking away the deduction for state and local taxes would likely doom this tax bill, in its current form, from ever being passed. There would be too much opposition to that, even though it makes sense from a simplification standpoint.

For corporations, the maximum tax rate would fall to 20% from 35%. But companies would now be taxed on international profits. Overall, it is estimated that this would add about $10 to S&P 500 earnings. It would also help small companies, even more, thus the big rally in small-caps.

The third tier to the tax plan would be the repatriation of US profits currently being held overseas at a reduced rate.

YELLEN ON RATES

Federal Reserve Chairwoman Janet Yellen said if the Fed determines that there are long-term changes in the trajectory of inflation that it could slow down the pace of interest rate increases. Inflation has been coming in lower than the Fed’s 2% target this year, leading some economists to want to keep interest rates lower for longer, but that also could lead to financial bubbles that would present bigger problems later.

Under the current scenario, the Fed will probably continue on the path of gradual rate hikes. The market is now expecting a December rate hike.

SCOREBOARD