HIGHLIGHTS

- Stocks finish flat for the week but explosive volatility in between.

- Economic numbers, highlighted by a strong jobs report, indicate the economy was accelerating economy before the impact of the virus.

- Interest rates continue to plunge.

- The yield on the S&P 500 now exceeds the 10-year yield by the most since 2008.

- Joe Biden is now the favorite to capture the nomination for the Democrats.

- The coronavirus continues to spread but while absolute numbers are small the economic impact will be big.

MARKET RECAP

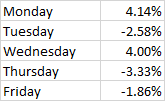

US stocks advanced for the week by the thinnest of margins, +0.1%, but it didn’t feel that way as stocks were way up or down every day. International stocks fell by 1.19%. Here is how it broke down day by day in the US:

The momentum from the late market rally from the prior Friday continued on Monday with the 4.14% advance. But that was reversed on Tuesday as the market fell late as the Fed was holding its news conference announcing a 1/2 percent interest rate cut. News of Joe Biden’s Super Tuesday performance helped the market rally by 4% on Wednesday. Then coronavirus fears dropped the market on Thursday. Friday was more of the same but stocks rallied 2.36% off of their lows late in the day to close down by 1.86%. Add it all up and stocks were pretty much flat for the week.

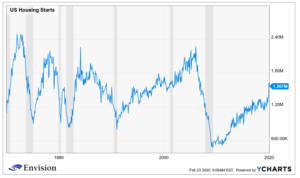

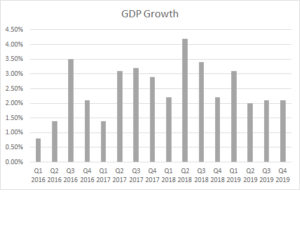

The wild ups and downs reflect the fact that no one knows how bad the virus will be and what will be the ultimate impact on the economy. Economic numbers that were reported this week were good, and show a US economy that is improving. The Atlanta Fed’s GDPNow model raised the Q1 estimate of growth to 3.1% from 2.7%. It was a blockbuster jobs report as nonfarm payrolls increased by 273,000 (the estimate was 175,000) and the unemployment rate dropped to 2.5%. December and January’s numbers were revised up by 243,000. But most of the survey was done before the coronavirus accelerated in the last couple of weeks. No one expects anything close to that for the next few months.

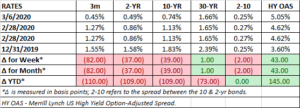

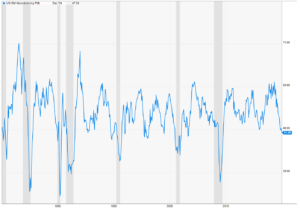

INTEREST RATES FALL HARD

The Fed on Tuesday cut interest rates by one-half point to a range of between 1% and 1.25%. It was the first time since 2008 that the Fed cut rates in between scheduled policy meetings. The market immediately sold-off on the news, probably realizing a rate cut would have minimal impact on the supply-side shock to the economy. Meanwhile, interest rates plunged. The 3-month treasury bill now yields 0.45%, which is down from 1.27% last week and 1.55% at the end of last year. The two and ten-year yield fell by about 37 and 39 basis points for the week. The 10-year yields an all-time low of 0.74% and the 30-year is at 1.66%. High-yield bonds are now at 5.05%, up from 4.62% last week. The falling interest rates indicate fixed income investors expect some bad times ahead.

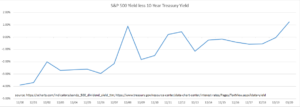

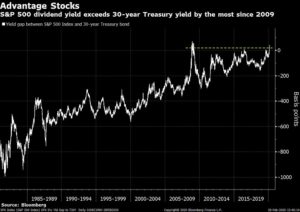

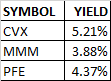

ADVANTAGE TO STOCKS BASED ON YIELD

The differential between the yield on the S&P 500 and the 10-year treasury are now at the highest levels since 2008. That doesn’t mean the bottom is in but stocks are attractive based on this valuation measure.

BIDEN IS THE ODDS ON FAVORITE

Biden’s surprise surge on Tuesday has vaulted him to be the front-runner for the Democrats according to fivethirtyeight.com. Along with the Tuesday performance, all of the remaining candidates have dropped out, giving Biden has an 89% chance of winning the Democratic nomination.

VIRUS

The coronavirus continues to spread but while absolute numbers are still small. the economic impact will be big. According to Johns Hopkins, there have been 107,000 confirmed cases as of Sunday morning and about 3,600 people have died. In the US, there are 440 cases over 32 states. The fear factor and efforts to minimize the spread of the virus are beginning to have a real economic impact. Cases in the US will probably skyrocket over the coming days just because testing will be going up dramatically.

SCOREBOARD