HIGHLIGHTS

- US stocks drop by 2.2% and international stocks were off by 3.38%.

- Bonds advanced by 0.76%.

- Fears of the coronavirus set stocks back.

- Q4 growth was 2.1%, 2.3% for the year.

MARKET RECAP

US equities fell by 2.2% on the week on fears of the spread of, and economic impact from, the coronavirus. Since the virus broke out on January 17th, stocks are off by 3.11%. The timing is about in line with the market peak in January of 2018, stocks were on a daily climb similar to what we have seen this year, almost every day until January 26, when trade war talk triggered a quick 10% drop. Time will tell whether we get a similar follow-through this time around.

International stocks took a bigger hit, down by 3.38%. Investors fled into treasuries, advancing bonds by 0.76%. The 3-month/10-year yield curve inverted, as the yield on the 10-year Treasury bond dropped by 19 basis points to 1.51%.

CORONAVIRUS

There are now six cases of coronavirus confirmed in the US, and about 10,000 around the world, and there have been 200 fatalities. The economic impact is being felt in China. Hong Kong suspended high-speed rail to China, and reduced airline flights. The Shanghai Disneyland has closed and Starbucks has temporarily closed about 1/2 of their stores. Airlines have canceled many flights to and from. Millions of Chinese are in lockdown. Chinese stocks are down by about 11% since the outbreak. Sectors that have been hit by the virus (in terms of equity prices) are airlines, tourism, and oil and gas.

Believe it or not, the name though has created some confusion, as some actually think the virus and the Corona beer are connected. Search engines have been flooded with inquiries about the “beer virus” or the “corona beer virus”.

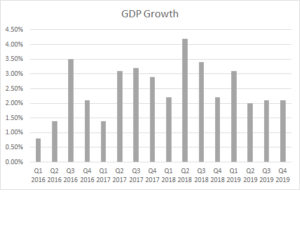

Q4 GROWTH

The Bureau of Economic Analysis reported that Q4 GDP grew by 2.1%, in line with Q3. For the year, GDP was up by 2.3%. Personal consumption, which comprises 2/3 of economic activity, rose by 1.8%, the slowest rate in three quarters.

EARNINGS

At the halfway mark of earnings season, 2/3 of S&P 500 companies that have reported have beat their estimates. Solid reports from market leaders Apple, Tesla, and Amazon have helped. Earnings for the quarter are now expected to be down 0.3% from last year, versus the original -1% estimate. The 2020 estimate looks for a 9% gain. Of course, that will come down with time.

BREXIT

It has been 1,316 days since British voters decided to leave the EU, and here it is. The UK has now officially left the European Union. There is now an 11-month transition period where the two parties will try to reach some sort of deal.

SCOREBOARD