HIGHLIGHTS

- Stocks were up around the world.

- A week of good economic reports.

- The deficit continues to spiral out of control.

- Buybacks make up the largest portion of cash spending in the first half of the year.

MARKET RECAP

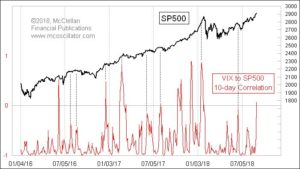

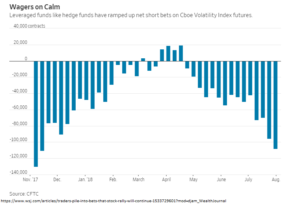

US stocks ended up 1.14% on good economic reports. Equities were also helped by emerging markets, which were up by 0.70%, calming fears, at least for now, of a never-ending fall that would drag down US stocks. International stocks increased by 1.52%. Technology had a good week, up 1.8%. Apple released its new line up of products and shares increased by 1.1%.

ECONOMY

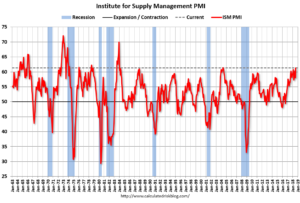

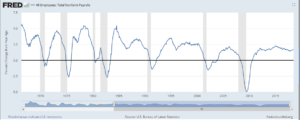

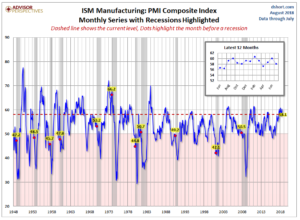

It was a week of strong economic reports. Industrial production was up 0.4% in August and July was revised up to 0.4% from 0.1%. Year over year, industrial production is up by 4.9%, the highest number since December of 2010.

Retail sales were up by 0.1% in August, showing some recent moderation in growth. But year over year, sales are up by 6.5%, the most since December of 2011.

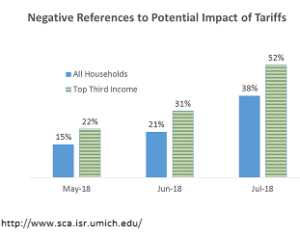

The University of Michigan Consumer Sentiment Index reported its second-highest reading since January of 2004, at 100.8.

DEFICIT

Barron’s cover story this week was on U.S. debt. We have written and spoken about this many times in the past. The deficit is one of those things that is not a problem until it becomes a problem. And when that happens, it is not going to be pretty. At some future point, investors are not going to want to finance U.S. debt. And then interest rates will skyrocket, or the Fed will have to print dollars, and the dollar will depreciate.

America currently owes $15.7 trillion, which is 78% of the gross domestic product (GDP). The Congressional Budget Office (CBO) estimates that in a decade debt will be $28.7 trillion, or 96% of GDP. And that assumes no catch up in infrastructure, no financial crisis, and no wars. It is one thing if debt increases in line with GDP growth. But that is not the projection. The CBO estimates nominal GDP growth at 4% and debt to rise at 4.9% over the next 10-years.

Neither political party has any interest in addressing this serious issue.

BUYBACKS

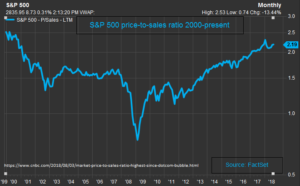

For the first half of the year, stock buybacks made up the largest percentage of cash spending by companies in the S&P 500. Buybacks were up by 48% and totaled $384 billion during that period. Capital spending increased by 19% to $341 billion.

TARIFFS / TRADE WAR

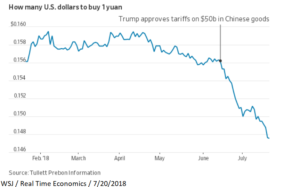

For all the talk of tariffs and a trade war, so far to date, they have yet to be implemented in mass. Currently, tariffs on imports effect about $113 billion in goods. That is 4% of all US exports. About $70 billion has been implemented on US exports or about 3% of the total. Trump has threatened tariffs on another $700 billion of imports.

SCOREBOARD