HIGHLIGHTS

- Solid earnings helped US equities to a small gain of 0.1%. International stocks were up 0.37%.

- Powell comments on free trade and then Trump fires back on interest rates.

- Higher US trade deficits might be on the way.

- Currency valuations are now in the spotlight as the yuan is falling.

MARKET RECAP

Strong corporate earnings helped offset trade and currency concerns as US equities managed a small gain of 0.1%. International stocks did better, up 0.37%. Of the 75 S&P 500 companies that reported earnings, 71 beat forecasts. Looking forward, analysts are still revising earnings forecasts higher for 2018, 2019 and 2020. And those strong earnings are powering this market, at least for now, despite concerns about the trade war. Earnings projections have been revised up over the last quarter (13-weeks) by 1.92%, 1.90%, and 1.58% respectively, per Thomson Reuters.

FED CHAIRMAN POWELL ON TRADE

In Congressional testimony, Fed Chairman Jerome Powell said the following regarding tariffs, “In general, countries that have remained open to trade that haven’t erected barriers including tariffs have grown faster, they’ve had higher incomes, higher productivity. And countries that have, you know, gone in a more protectionist direction have—have done worse.”

Trump then criticized Powell, saying that raising short-term interest rates will hurt the US economic expansion. Traditionally, presidents have refrained from speaking about monetary policy. If Trump is worried about hurting the economic expansion, he should first look at this trade policies, but conveniently, he is setting up Powell to be the fall guy if the economy begins to slow.

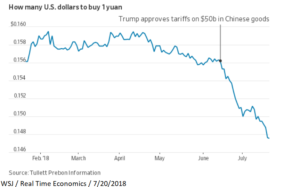

CURRENCY WAR NEXT?

As we wrote a couple weeks back, “beware the law of unintended consequences.” Here are a couple to start – a higher US trade deficit and currency wars. Rising US interest rates, the beginning of the trade war, and slowing Chinese growth have been pushing the value of the Chinese yuan down. Over the last month, the yuan has fallen about 5% against the dollar. The weaker yuan offsets some of the impact of U.S. tariffs by making Chinese goods cheaper in the U.S. and U.S. goods more expensive in China., the result might be a higher trade deficit with China. The exact opposite of the intended impact of the U.S. tariff policy.

As the yuan has dropped, there was little sign that China’s central bank intervened to help halt or slow the slide, so Trump accused China as well as Europe of “manipulating their currencies and interest rates lower.” Jens Nordvig, a currency strategist at Exante Data said, “The real risk is we have a broad-based unraveling of global trade and currency cooperation, and that is not going to be pretty.” Nordvig fears the trade war will shift to a currency war.

SCOREBOARD