HIGHLIGHTS

- US stocks increase by 0.72% but international stocks fall by 0.81%.

- Another strong payroll report.

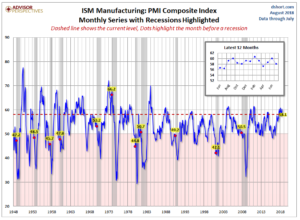

- The ISM Manufacturers Index falls by the most in two years and hits a 3-month low, but the level is still high.

- More tariff threats between the US and China.

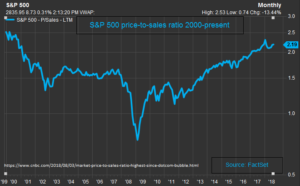

- The price to sales ratio is approaching highs last reached around 2000.

- Apple becomes the first company to be valued at $1 trillion.

MARKET PERFORMANCE

US and international markets split ways again, with the US up by about 0.72% and international markets down by 0.81%. There was the normal back and forth on tariff threats with China, but the market does not seem so concerned. A solid payroll report showed that the labor market continues to be tight. The only kink in the armor of the strong US economy was a fall in the ISM Manufacturing Index to a 3-month low. But the reading of 58.1 is still extremely strong. Apple won the race to the $1 trillion valuation, hitting the mark on Thursday.

PAYROLL

Nonfarm payrolls increased by 157,000 and the two preceding months were revised up by a total of 59,000. So far, the tariffs do not seem to have impacted hiring. Average hourly earnings were up 2.7% compared to last year. One factor holding down bigger increases in average earnings is that employers have been hiring less educated, lower paid workers to fill job positions. A related factor is an increase in jobs for the 25 to 34-year old’s, they are replacing older, higher paid employees as they begin to retire. The unemployment rate dropped to 3.9%. Overall, the labor market continues to be strong.

ISM

The ISM Manufacturing Index fell by 2.1 points in July, the most in almost two years, to 58.1. The reading was a three-month low and indicates some moderation in factory activity. Despite the decline, the overall level of 58.1 is still a very strong number and indicates continued growth for Q3 although probably weaker than Q2.

The report stated that “respondents are again overwhelmingly concerned about how tariff-related activity, including reciprocal tariffs, will continue to affect their business.”

TRADE

The back and forth that trade wars are known for continued this week. The White House threatened to increase tariffs to 25% on $200 billion of Chinese goods from the previously announced amount of 10%. China responded on Friday saying that it would increase tariffs up to 25% on $60 billion of US products. These tariffs are supposed to go into effect in September. The Chinese yuan is down 7% versus the dollar over the last two months. That will help the Chinese deal with the higher tariffs.

If Chinese exports are hurt by the trade war, the government might be inclined to stimulate the economy by taking on more debt. The problem is that China is close to being maxed out on debt. Pushing China over the edge into a full-blown debt crisis would likely lead to problems throughout the global economic system.

VALUATION

There are lots of metrics out there showing that the market is overvalued, and some showing it is fairly valued, but here is one that indicates the market is way overvalued. Price to sales on the S&P 500 is at about 2.2, near the highest level since 2000.

APPLE

On Thursday Apple became the first company to reach a valuation of $1 trillion. Apple trades just under the S&P 500 index multiple, selling at 15.8 forward earnings.

SCOREBOARD