HIGHLIGHTS

- Stocks advance around the world.

- The S&P 500 breaks through its March and June highs, now 2.5% from the top.

- The White House proposes more tariffs on China.

- Consumer Confidence declines.

- Inflation increases at the fastest pace in six years.

MARKET RECAP

It was another up week around the world, and another week of tariffs. The White House said it would add 10% tariffs on $200 billion in Chinese products. The tariffs won’t take effect for two months. Supposedly the recently enacted tariffs and the threat of the new tariffs are intended to open up markets, but the administration has yet to clearly state what their objectives are, and one must wonder if they even know. The market did fall about 1/2% on the news, but otherwise, stocks were up every day last week.

US equities were up 1.34% and international markets advanced by 0.57%. The S&P 500 cleared its March and June highs and is now 2.5% off the January 26 all-time high price. Interest rates increased by about 5 basis points. The spread between the 2 and the 10-year Treasury’s fell to 28 basis points (down 1 bp).

CONSUMER CONFIDENCE

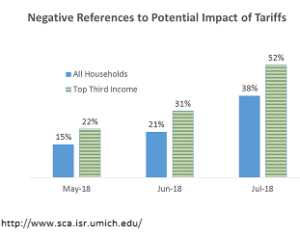

The market is going one way, but consumer confidence is going the other. The University of Michigan’s Consumer Sentiment Survey declined. Chief Economist Richard Curtin said “The darkening cloud on the horizon, however, is due to rising concerns about the potential negative impact of tariffs on the domestic economy. Negative concerns about the impact of tariffs have recently accelerated, rising from 15% in May, to 21% in June, and 38% in July (see the chart). Among those in the top third of the income distribution (who account for half of consumer spending), 52% negatively mentioned the impact of tariffs on the economy in early July. The primary concerns expressed by consumers were a decline in the future pace of economic growth and an uptick in inflation.”

INFLATION

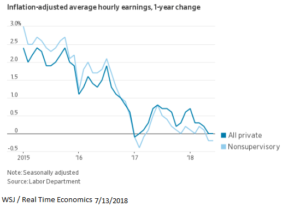

Inflation rose to the highest rate in six years. The Consumer Price Index was up 2.9% year over year. Inflation is now rising faster than average hourly wage growth, meaning earnings are not keeping up with the cost of living.

SCOREBOARD