HIGHLIGHTS

- Markets fall by 7.23% in the US.

- Fed increases rates by 1/4 point and indicate two more hikes next year.

- Government shutdown begins.

- Defense Secretary Jim Mattis resigns.

- There is extreme negative sentiment in the market.

- FedEx CEO comments on the worldwide slowdown.

- The end of quantitative easing.

- Oil is down 40% since October.

MARKET RECAP

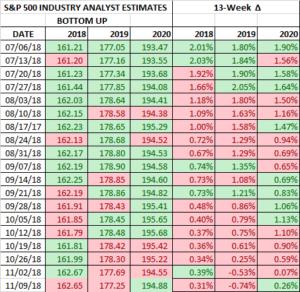

Stocks got slaughtered as US equities fell by 7.23%. It was the worst week since 2008. The NASDAQ, which fell 8.4%, is now off by 21% since its August 29th high. The overall market is down by 18% since its September 20th high. The Dow is setting up to have its worst December since 1931. And the consensus is that more is on the way. Unfortunately, bear markets are part of normal market behavior (although infrequent), and the excess returns equity investors receive over time are attributable to the greater risk they take on in comparison to safer assets.

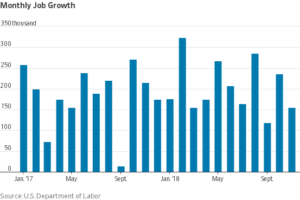

The Fed got most of the blame for this week’s fall. As expected, the Fed increased rates by 1/4 point on Wednesday. But the market was hoping for a “dovish” increase. That is supposed to mean the Fed would increase rates by 1/4 point, and then state that further increases would be dependent upon the data. Powell’s comments were interpreted as too hawkish, as he indicated another couple of hikes were in the current plans and there would be no slowdown in the roll off of the Fed’s balance sheet. To the Fed, the economy in the US continues to look solid.

The market might have taken a hit no matter what Powell said, after all, the market was down by 2% on Monday alone and had been falling prior to that. The Fed even backtracked on Friday, when John Williams, President of the Fed of New York, said that the central bank was closely watching the economy. Williams stated “[we are] listening to not only markets but everybody that we talk to, looking at all the data and being ready to reassess and re-evaluate our views.” That led to a big Friday rally that sent the Dow up by 350 points early, but the market couldn’t hold the gains and stocks ended down by 2.12%.

But there was more than enough other negative news to give the market a reason to decline. The government went into a shutdown mode on Friday as the White House and Congress could not agree on funding for the wall along the border with Mexico. Trump made an abrupt decision to draw down troops in Syria and Afghanistan, leading to the resignation of Defense Secretary Jim Mattis. Mattis becomes the latest in a long line of respected members of the White House team to leave. Early on in this administration, those fearful of Trump’s worst tendencies were told he was surrounded by a very competent team, but that argument is basically null and void at this point. Are there any “adults” left in the White House?

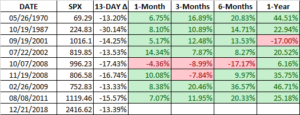

If there is any glimmer of hope it might be in the fact that everything is so negative. The last interim high on the S&P 500 was on 12/3/2018. In the 13-trading days since then, the index has fallen by 13.4%. An extraordinary drop in a short period of time. We found 8 other times since 1970 when the index has fallen by 13% or more in 13-trading days. Looking forward 1-year (see the right-hand column below), the market was up seven of eight times. We are not making a call on that, but pointing out what has happened in the past.

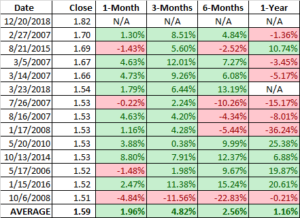

The CBOE Options Total Put/Call ratio reached its all-time high on Thursday of 1.82 (the calculation began in 1995). This indicates extreme negative sentiment as traders are buying lots of insurance (puts) to protect against further market declines. Below are the results when the reading has been above 1.50 going back to 1995.

FEDEX

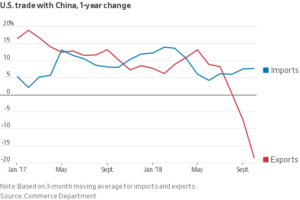

FedEx can be viewed as a good bellwether on the world economy. On the earnings call, the company indicated that overseas economies are slowing down while the US still remains in good shape. FedEx mentioned the UK and Europe were in sharp slowdowns. FedEx sited bad economic choices as the primary reason for economic weakness, including Brexit, the immigration crisis in Germany, mercantilism and state-owned initiatives in China, and tariffs in the US.

| Most of the issues that we are dealing with today are induced by bad political choices. I mean, making a bad decision about a new tax, creating tremendously difficult situation with Brexit, the immigration crisis in Germany, the mercantilism and state-owned enterprise initiatives in China, the tariffs that the United States put in unilaterally. So you just go down the list, and they’re all things that have created macroeconomic slowdown. |

| Federal Express CEO Frederick Smith, on an earnings call |

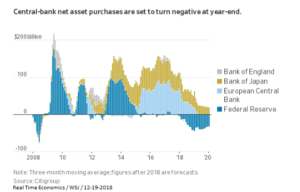

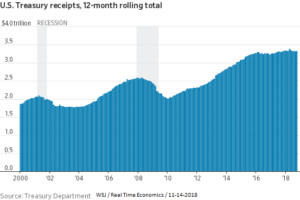

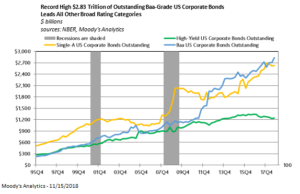

CENTRAL BANK PURCHASES

One factor impacting markets is the end of quantitative easing around the world. Central banks are no longer pumping money into economies worldwide. The US stopped in October of 2017, and since then has been doing the opposite, effectively taking money out of the system as they let bonds mature without reinvesting the funds. Meanwhile, the European Central Bank will end its money-printing program at the end of this month, however, they will continue to reinvest the proceeds as bonds mature. Japan’s program remains in place. But overall, the net impact will turn negative by year-end.

OIL

Oil dropped by 11% for the week and is down 40% since October 3rd. The dramatic fall coupled with the sell-off in stock market leads some investors to believe there is something fundamentally wrong with economies worldwide. But it might be more of a supply than a demand issue. US production was up 16% in 2018 and should be up 11% next year (according to the Department of Energy).

SCOREBOARD

The purpose of this commentary is to provide readers with a summary of recent market and economic news. It is not intended to provide trading or investment advice. Investors should have a long-term plan and should consider working with a professional investment advisor. Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The information and opinions contained in this material are derived from sources believed to be reliable, but they are not necessarily all-inclusive and are not guaranteed as to accuracy. Any forecasts may not prove to be correct. Economic predictions are based on estimates and are subject to change. Reliance upon information in this material is at the sole discretion of the reader.