HIGHLIGHTS

- Stocks are up for the second week in a row.

- As expected, the Democrats take control of the House and Republicans maintain control of the Senate.

- 2019 earnings estimates have been falling the last few weeks.

- Q4 growth estimates are in line with last year at this time but down from the two most recent quarters.

- Tariffs threaten the economy.

MARKET RECAP

Stocks made it back to back winning weeks, helped by a post-election rally that pushed US equities up by 2.04% on Wednesday. For the week, the US advanced by 2.79% and international stocks were up by 3.88%. Bonds were down by 0.58%. The spread between the 2 and the 10-year treasury notes widened to 31 basis points as the 10-year moved up to 3.22%.

From a technical perspective (see the chart of the VTI below), in the fight to regain positive momentum, stocks broke above the 200-day moving average on Wednesday, and held above it on Thursday, but closed on Friday just below the 200-day average by the smallest of margins (11 cents). However, on a chart of the S&P 500, the closing price was slightly above its 200-day moving average. But in both cases, the rally stalled out right at the high of the October 15th (see the white line).

MIDTERM ELECTIONS

The elections turned out as predicted with the Democrats adding over 30 seats to take control of the House and the Republicans improved their numbers in the Senate. The market took a divided Congress as a positive sign for the markets on the theory that gridlock is good.

EARNINGS

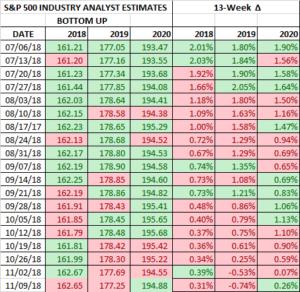

Right now the S&P 500 is selling at 15.7x estimated 2019 earnings, a reasonable valuation if those estimates can hold. Earnings for 2019 are expected to be $177.25 according to Thomson Reuters, up from $162.65 this year. That would be a solid increase of about 9%. But for the last month, the 2019 estimates have been falling week by week, and for the first time, the 2019 estimates are less than they were one-quarter (13-weeks) ago. They are only off by 0.74% during that period, but it is a trend worth watching.

ECONOMY

The Atlanta Fed’s GDPNow model is forecasting Q3 growth at 2.9%. The NY Fed’s Nowcast has growth at 2.69%. Those numbers would be roughly in line with Q4 of 2017 and down from Q2 and Q3. The composite reading of the Institute for Supply Management (ISM) came in at 60.3, down from 61.6. That is a very high reading and it was the first time in the history of the report, which dates back to 1997, that the reading was above 60 for two consecutive months.

Tariffs are a threat to the economy. A paper titled “Macroeconomic Consequences of Tariffs” and written by Davide Furceri, Swarnali Hannan, Jonathan Osry and Andrew Rose, released last month, reviewed the impact of tariffs from 1963 and 2014. The authors write “We find that tariff increases lead, in the medium term, to economically and statistically significant declines in domestic output and productivity. Tariff increases also result in more unemployment, higher inequality, and real exchange rate appreciation, but only small effects on the trade balance.” Let’s hope the President reads this paper.

SCOREBOARD