MARKET RECAP

Well, the week got off to a good start, but it turned vicious as stocks tumbled by 4.56%. International stocks were down 3.13%. It was the worst start to a December since 2008.

Stocks rallied on Monday, up by 1.17%, on the news that at the G20 summit, the US and China had agreed to a 90-day delay in the implementation of the next set of tariffs. Furthermore, Trump sounded very optimistic that the two countries would reach a final deal. But that ended the very next day when Trump declared that “I am a Tariff Man,” stocks fell by 3.27%. The market was closed on Wednesday due to the funeral of former President George H. W. Bush. On Thursday, it was reported that Meng Wanzhou, the chief financial officer of Huawei Technologies, a very important Chinese technology company, was arrested in Canada on a request from the US for alleged violation of Iran sanctions. Meng is also the daughter of Huawei’s founder. Stocks opened down on the news and then fell as much as 2.88% before staging a furious rally and essentially ending the day unchanged. The rally did not carry through to Friday when equities fell another 2.36%, close to the Thursday low.

If you boil it all down to one factor, investors are worried that a recession is on the way in the next year or so. But such worries do not always turn out to be true. Two recent examples, remember January of 2016 when the weak Chinese yuan and collapsing oil prices spooked investors. And the debt ceiling crisis in 2011. Neither resulted in recessions. Not to mention all the concerns about Europe earlier in this decade.

That is not to say there is no recession on the way. There are certainly signs that the economy is at least decelerating. The Atlanta Fed’s GDPNow model currently projects growth at 2.4% this quarter.

TECHNICALS

The overall US market is now pushing dangerously close to a support level it has bounced off two other times since late October (see points 2, 4 and 6 below). On the Monday rally (point 5 below), you will see the market failed to push through resistance, same as it had previously at points 1 and 3. So if the market can hold support here, it would appear that we are in some kind of consolidation pattern between $134.60 and $144. We looked at a couple of past bear markets with a somewhat similar pattern. In 1973, stocks fell through support on the third test which led to an acceleration of the bear market. In 1981, stocks held support and consolidated for another 8 months, before continuing their downtrend. There is also the possibility that the Friday low marks the bottom of this correction. The truth is nobody knows.

At least one small signal of technical strength is that the S&P 500’s cumulative advance/decline line has been holding up, putting in two recent higher highs and higher lows (Bespoke Report 12/7/18).

YIELD CURVE

Investors also freaked out about a slight yield curve inversion between the 2 and 5-year treasury bonds. A yield curve inverts when a shorter-term bond yields more than a longer-term bond. In this case, as of the Friday close, the two-year bond yielded 2.72% and the five-year was at 2.70%. In the past, an inverted yield curve has forewarned of a recession. But economists normally compare the 2-year against the 10-year, or the 3-month against the 10-year, not the 2-year and 5-year.

In any case, what does a yield curve inversion mean for the economy and for investors? Aswath Damodaran, a Professor of Finance at New York University, after running the numbers, concludes that the “…predictive power [of an inversion] for the economy is weak and for the market, even weaker. The other thing is that we are taking rules of thumb developed in the US in the last century and assuming that they still work in a vastly different economic environment.” You can find Professor Damodaran’s commentary here.

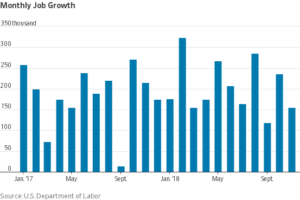

JOBS

Job growth came in at 155,000 for November, short of the consensus of 198,000. The three-month average is now 170,000, which is the lowest number in a year. The 155k increase shows growth, but at a slower pace than we had previously seen. This is in line with other cautionary signals that the economy is decelerating, such as slightly initial claims for unemployment, declining housing activity, and a flatter yield curve.

Initial claims for unemployment insurance fell by 4,000 to 231,000. The four-week average is 228,000, the highest level since April. The trend now has turned up since September 15. However, historically the number is still very low. And this is not the first time that the trend has turned up. It has happened many times over the last few years, only to resume its downward trajectory.

PMIs

Markit released its monthly report for composite PMI data for 23 countries in November, and the numbers came in somewhat positive. Overall the report showed an increase of 0.3. Emerging markets led the gain, up by 0.6 on average, with many countries showing a 1+ gain, including India (+1.5), China (+1.4), Brazil (+1.1) and South Africa (+1.3). Developed markets did not fare as well, down by 0.1. The Eurozone was down by 0.4 and the flash report for the US fell by 0.5. Overall all, of the 23 countries, 18 were above 50, indicating they were in an expansionary mode.

ISM

The Institute for Supply Management’s Non-Manufacturing Index was also positive. The November reading came in at 60.7, the second highest level since August of 2005, indicating above-trend expansion.

TRADE DEFICIT

American companies are now paying record amounts in tariffs, as the latest round in Trump’s trade war with China has begun kicking in. Yes, we said “American companies” are paying the tariffs. Not China. Tariff collections totaled $5 billion in October. Trump loves this extra revenue, stating “We are right now taking in $billions in Tariffs. MAKE AMERICAN RICH AGAIN.”

But while revenue to the government is up, the tariffs are causing real pain to American business. The tariffs also have not helped the trade deficit, which was one of Trump’s big complaints. In fact, the trade deficit is getting larger. The US trade deficit just reached its highest level in 10-years. That is because imports have remained steady, even in the face of the tariffs, while exports have plunged.

SCOREBOARD

QUESTIONS/COMMENTS

Contact us with any questions or comments.