HIGHLIGHTS

- US stocks fall by about 1.5% and international stocks are about flat.

- The out-of-control US deficit gets off to a terrible start in October.

- Some speculation that Fed might slow up on increases next year.

- Record amounts of Baa rated debt could be a trouble spot in an economic slowdown.

- Some weak economic numbers from Germany and Japan.

MARKET RECAP

US stocks fell by just under 1.5% for the week, while international equities continued their recent outperformance, down by just 0.06%. Treasury rates fell along the curve, but high yield spreads expanded. While the 10-year treasury dropped by 11 basis points, the high yield option-adjusted spread increased by 30 basis points, an indication that some fear is creeping into the credit markets.

Stocks were down the first three days of the week. On Thursday and Friday, the market rallied on hopes that the Fed will start to get the message that maybe they should take a more gradual approach to interest rate increases. Also, Trump said on Friday that China wanted a trade deal and that maybe an additional hike in tariffs is not needed.

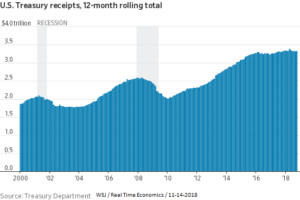

US DEFICIT

The 2019 fiscal year for the Federal government got off to a terrible start in October (the first month) as the budget deficit widened to $100 billion in October. That is up from $63 billion the prior year. A massive increase that continues to be ignored but just about every politician in Washington. Federal outlays increased by 18% because of higher spending on Medicare, defense and interest. Receipts were up by 7%. The bad part is that unless this problem is dealt with, it is only getting worse from here due to increasing entitlement spending, more and more interest expense and lost revenue from the tax cuts. The idea behind the tax cuts is that greater growth would eventually lead to a net increase in revenues. That has yet to happen.

The Congressional budget office estimates the deficit will hit $1 trillion this year.

INTEREST RATES

The conventional wisdom is that the Fed will continue to increase interest rates from here over the next year. But that might be wrong. While a December increase appears to be in the cards, the Fed can signal at the December meeting that it might consider a more gradual pace to future increases given economic weakness abroad and lower commodity prices. John Lonski, Chief Economist at Moody’s Capital Research, writes that industrial metals are down by 11% year over year, and that historically, such a drop in prices has often led to a lower 10-year treasury yield. If the Fed were to persist with increases at the same time that the 10-year yield is falling, that could lead to an inversion of the yield curve, a situation they might want to avoid.

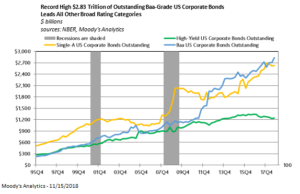

RECORD Baa Debt

There is a record amount of debt rated Baa, just above investment grade. As of Q3, there was a record high of $2.83 trillion, which exceeded the amount of single-A corporate credit. This is not usually the case, as shown below, prior to the recession in 2001 and 2008 single-A debt was greater than the amount of Baa’s. If the economy begins to falter, a good amount of the Baa’s might drop into high-yield (junk) status, that could increase interest rates in the high-yield market, leading to more problems as the weakest companies must deal with higher interest expense and refinancing issues.

WRONG TURN

The global economy took a wrong turn as Japan and Germany reported GDP that contracted in Q3. Germany dropped by 0.8% and Japan was down by 1.2%. German economists said that temporary factors caused the drop. Japan blamed the fall on a typhoon and an earthquake. Overall, the Eurozone managed a small increase of 0.7%, the lowest reading since 2013. In comparison, China was up by 6.5% and the US by 3.5%.

But all is not well in China. China reported slower consumer spending in October. Retail sales were up by 8.6%. That would be a monstrous gain in the US, but for China, that was the slowest increase in five months.

SCOREBOARD