HIGHLIGHTS

- Stocks close out 2019 with a 30.67% gain in the US and 21.75% outside the US.

- A small fall for the week after news that a US drone takes out an Iranian general.

- US and China to sign the phase-one trade deal on January 15.

- The ISM manufacturing index falls for the fifth month in a row.

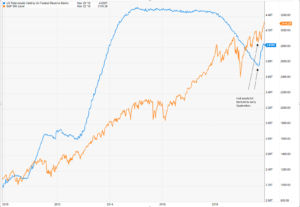

- The Fed’s increase in assets since late August has coincided with a 13% market advance.

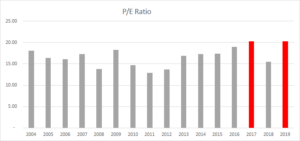

- Shiller warns about the CAPE ratio.

MARKET RECAP

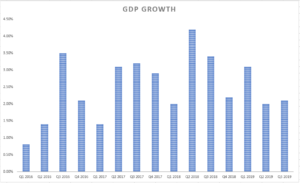

Stocks closed out 2019 with a 30.67% gain in the US and 21.75% outside the US. Bonds were up 8.46%. It was an amazing year.

For the week overall, stocks lost a little bit of ground, down 0.09% in the US and 0.50% x-US. The market got off to a good start on Thursday, the first trading day of the year, setting a new high and up 0.83%. But on Friday stocks closed down by 0.64%, on news that a US drone killed a top Iranian general, Qassem Soleimani. It was reported that Soleimani was planning further attacks on US forces.

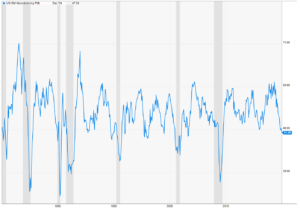

In other news, the US and China are set to sign the phase-one trade deal on January 15th and to begin talks on phase-two shortly thereafter. The ISM manufacturing index fell to 47.2 in December from 48.1 in November. It was the fifth consecutive decline.

The Fed has increased its assets by $410 billion since late August. That is about when the market went on its run to close out the year, the S&P500 was up by 12.75% during that period.

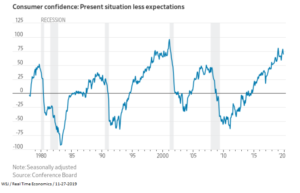

There seems to be a lot of complacency in the market, there is almost no fear. The CNN Fear & Greed Index was up to 97 out of a possible 100 on Thursday but closed at 93 on Friday, still in the Extreme Greed category, but valuations, at least by one measure, are very high.

Robert Shiller, Nobel Prize winner and developer of the Cyclically Adjusted Price Earnings (CAPE) ratio wrote in the New York Times on Thursday, that the CAPE ratio currently stands at 31, just short of the recent high in January of 2018. Only two times in history has the ratio been higher, 1929, just before an 85% crash, and in 1999, before a 50% drop. Shiller attributes today’s high values to a “trust your gut” kind of mentality, versus an evaluation based on science and math. Shiller writes, “We have a stock market today that is less sensible and orderly than usual, because of the disconnect between dreams and expertise.”

SCOREBOARD