HIGHLIGHTS

- US stocks increase by 1.19% for the week and 3.79% for the month.

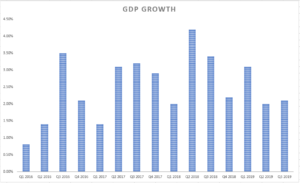

- The GDPNow estimate for Q4 growth increased markedly higher.

- Q3 GDP growth is increased to 2.1% from 1.9%.

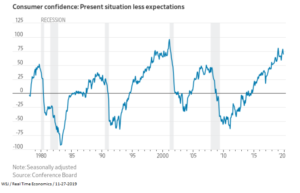

- The spread between the Present Situations Index and the Expectations Index might indicate an economic turning point.

MARKET RECAP

US stocks moved 1.19% higher for the week while international stocks barely broke even (+0.07%) and bonds were flat. The consensus is that odds of a recession in the next year or so are declining. Q3 growth was revised higher and Q4 estimates also were increased this week on better economic news.

For the month, US stocks were up by 3.79% and international stocks managed a 0.99% gain.

GDPNOW JUMPS HIGHER

The Atlanta Fed’s GDPNow model estimate for Q4 growth shot higher to 1.7% on the November 27th reading from 0.4% on November 19th. The 1.3% jump is about the largest we can recall in such a short period. Part of the move was due to the increase in durable goods orders, which were up by 0.6% due to higher defense spending.

Q3 GDP REVISED UP

The second estimate of real GDP growth for Q3 came in at 2.1%, up from 1.9% in the original estimate. The 2.1% growth tops the 2.0% growth in Q2.

CONSUMER CONFIDENCE

Two components of The Conference Board’s Consumer Confidence Survey are the Present Situation Index, which measures consumers’ assessment of current conditions, and the Expectations Index, which measures consumers’ short-term outlook for income, business and labor market conditions. When the difference between the Present Situation Index and the Expectations Index has peaked, it has often preceded a recession. Of course, there is no way to know if the graph below represents a peak or a short-term pause, but it does indicate a possible turning point.

SCOREBOARD