HIGHLIGHTS

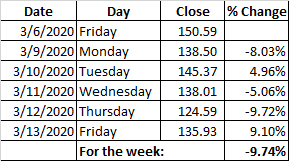

- Stocks fall by 9.74% for the week.

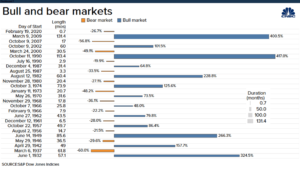

- We are now in a bear market, off by 27% as of Thursday.

- An all-out price war between Saudia Arabia and Russia exasperated the sell-off.

- Life changes in the US as lots of things begin to shut down, but more needs to be done and quickly.

- China has shown great success in getting the virus under control.

- We don’t think the world is coming to an end!

- Some advice from Baron Rothchild.

MARKET RECAP

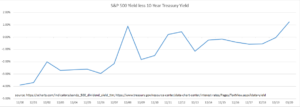

Stocks got hammered again, falling by 9.74% in the US and international markets dropped by 13.74%.

(price of VTI – Vanguard Total Stock Market Index)

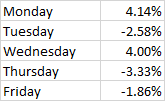

The week did not get off to a good start. The price of oil collapsed on Monday after Saudia Arabia and Russia got into an all-out war for market share, each trying to max out on production. Oil prices went into a tailspin and the equity markets followed, fearful of mass defaults on loans to the energy sector in the US. Stocks in the S&P Energy sector fell by a stunning 20% on Monday and by 8.03% overall. Energy prices were already way down from the coronavirus but this was another shock at the wrong time in the wrong place. West Texas Intermediate fell 25% to $31.13 per barrel and Brent Crude, the international benchmark, dropped 24% to close at $34.36. It was the biggest decline since the Persian Gulf War in 1991.

On Tuesday and Wednesday, stocks traded gains and losses, up by 4.96% on Tuesday followed by a 5.06% loss on Wednesday.

On Thursday, stocks suffered their biggest loss since the crash of 1987, falling by 9.72%. Aside from 1987, there were only three other days where the market suffered a bigger fall, and they were all in 1929 (10/28/29, 10/29/29, and 11/6/29). That put stocks officially into a “bear” market, a decline of 20% or more. At the Thursday close, the Vanguard Total Stock Market Index fund (VTI) was down by 27.44% from the February 14 high. The US started to shut down on Thursday as some schools, Disneyland, and the NBA all announced closures.

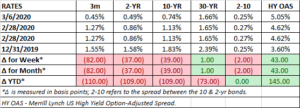

Markets rallied by 9.10% on Friday as Trump declared a National Emergency and was close to a deal with the Democrats on a relief package. Trump’s declaration of a national emergency opens up access to $50 billion in financial assistance for states and localities. The Fed said it would buy $33 billion of bonds to improve the functioning of the markets and would make $1.5 trillion of short-term financing available. As of the close Friday, stocks were down by 20.83% from the high and down 16.92% year-to-date.

LIFE IS CHANGING FAST

Italy which has been hit hard has basically shut down for a few weeks. Trump announced a ban on flights to and from Europe. Europe has become the new epicenter of the disease and the US is probably not far behind. All of the major sports leagues and the NCAA have postponed or canceled their seasons. Schools in at least 12 states, including Florida, are going to be closed for a few weeks, and public gatherings of more than 200 or so are either prohibited or are being canceled. The aim is to “flatten the curve” so that Covid-19 cases don’t pop in such a manner as to overwhelm the health care system.

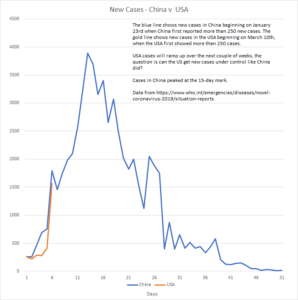

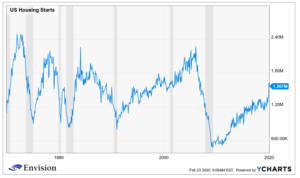

While the measures above may seem tough, they are probably not enough. A full lockdown of the country (except for essential type businesses) similar to what China did, will probably be necessary to stop the virus in its path. And the US will have to act fast before it becomes too late. Cases in the US will begin ramping up immediately if we follow a similar path to China (see graph below). But China has shown the path on how to get the virus under control.

APPLE CLOSES ALL STORES OUTSIDE OF CHINA

Apple announced they will close all stores outside of greater China until March 27th. Tim Cook, Apple CEO, said that “the most effective way to minimize [the] risk of the virus’s transmission is to reduce density and maximize social distance.” The fact that stores will be open in China, but closed outside China, tells you all you need to know about how successful China has been in, at least so far, turning the tide on Covid-19.

While the virus started in China and was exploding there, so far about 80,000 plus cases, from the time new cases had reached 250+ on January 23, China peaked in new cases only 17 days later on February 10th, and remarkably, has been declining ever since. There have been less than 40 new cases reported in China every day since Tuesday, with only 11 on Friday and 18 on Saturday. China has shown the virus can be beaten and in short order. That is the bright spot that shows it can be done. That is the path the US needs to follow.

It remains to be seen if China can keep the numbers down as they return to normalcy. But for now, the turnaround is nothing short of remarkable and the US and the rest of the world will have to learn from China’s success. That will require quick action which at least for now, doesn’t seem like it is coming. There are a lot of half-measures now in place in the US but it will take a full-court press to beat down the virus.

THE WORLD IS NOT COMING TO AN END

While there is a feeling of panic in the streets (and the markets), we don’t think the world is coming to an end. Although life and financial markets can get much worse before they get better. China (as well as Korea) have shown that the virus can be brought under control. Furthermore, this is not the first pandemic. We wrote a couple of weeks back about the Spanish Flu, the Asian Flu, the Hong Kong Flu, and SARS and they all eventually faded. While Covid-19 is probably the worst since the Spanish Flu (1918), at some point there will be therapeutics and a vaccine to knock it out, and until then, there will be lots of tough adjustments to life. Fast and strong measures can work. China and Korea have shown that. China seems to have turned around the growth of the virus in less than a month, time will tell if it can keep it down, but so far it is encouraging. Governments around the world will be pouring in billions, probably trillions, to support their economies. Once the turn in the virus happens, we are hopeful that economic growth will quickly rebound.

During past flu scares, governments never took the kind of actions we are seeing today. So how this plays out economically is an unknown. There is a legitimate worry that there is too much corporate debt out there, and a weak economy will throw a lot of companies overboard. The near-term economic future is unknown and will get worse before it gets better. While we would hope for a V-shaped economic recovery, there is the risk of a U shaped recovery, where the economy falls and then goes sideways for a while, and then increases back to normal.

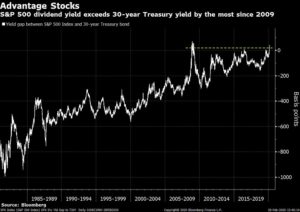

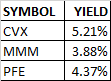

But these are the kinds of moments that the legendary investors have taken advantage of in the past. As Baron Rothchild famously said in the 18th century, “the time to buy is when there is blood in the streets.” He learned that from the Battle of the Waterloo against Napoleon. If history is any guide, unless we are going to go into a Great Depression, investors with a long-term focus and that are not overallocated to equities for their risk tolerance (consult a financial advisor) should consider taking advantage of this sell-off. We would not be jumping in all at once, to be clear, stocks can certainly decline a lot more from here, but small purchases here and there in financially strong companies, now and as the market declines further should work out over time. Of course, there are no guarantees. No one knows what the future of the stock market holds, but buying at times when it hurts the most has usually worked out.

SCOREBOARD