HIGHLIGHTS

- Stocks fall slightly, by 0.23% in the US and 0.52% x-US.

- Reports earlier today that China will increase penalties on IP theft.

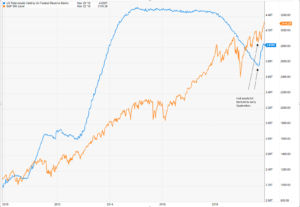

- The increase in the Fed balance sheet since September has coincided with the recent market rally.

- Strong reports on residential real estate.

- Higher threat of leveraged loan defaults.

MARKET RECAP

The market rally went on hold this week as US stocks declined by 0.23% and international equities fell by 0.52%. Bonds rallied as the longer end of the curve saw interest rates fall. The spread between the 2 and 10-year treasuries declined by 7 basis points. Progress on the trade dispute between the US and China also seemed to stall, but it was reported just a couple of hours ago (Sunday – 11/24/2019) that China has agreed to increase penalties on the theft of intellectual property, a major sticking point in the trade talks.

FED BALANCE SHEET

The Fed has increased the size of its balance sheet from about $3.76 trillion in early September to about $4.03 trillion currently. That is an increase of $270 billion in just 2-1/2 months. The purpose of the increase was to stabilize the repo market, and the Fed has claimed that this is not quantitative easing, but the effect is the same. More assets in the system provide more fuel to push equity prices higher. Not coincidentally, the market has been moving higher since the change in policy.

HOME SALES / BUILDING PERMITS

Good news on the residential front, existing-home sales increased 4.6% year over year. That was the fourth consecutive month of higher sales which followed a 16 consecutive month decrease. Building permits for privately-owned housing units were up 5% in October from September and 14.1% year over year.

LEVERAGED LOAN DEFAULTS

Analytics firm Credit Benchmark says that a recent survey of data collected from banks, insurers, and asset managers has raised the average probability of defaults on leveraged loans to about 6% in September versus 5.4% one year prior. Leveraged loans are often used by private equity for financing the buyouts of companies. Given the recent run of low-interest rates over the last decade, many companies are now loaded up on such loans. Almost 60% of companies purchased in leveraged buyouts carry debt of more than 6x earnings before interest, taxes, depreciation, and amortization (ebitda). A turn in the economy could lead to trouble for these companies quicker than normal.

SCOREBOARD