HIGHLIGHTS

- Stocks are up by 3.2% in the US and 2.1% x-US.

- Another strong jobs report.

- Macy’s to lay off 2,000.

- Tesla’s stock continues burning higher.

- Solid ISM report.

- The trade deficit falls slightly.

- A disaster for the Iowa caucuses.

MARKET RECAP

Stocks had a big week advancing by 3.2% in the US and by 2.1% around the world. Bonds fell by 0.38%. Stocks were all but oblivious to the fact that a good portion of China has been paralyzed by the coronavirus. Markets were probably helped when China pumped billions of dollars into their economy to help offset the economic impact of the virus. Tesla’s stock has been on a parabolic rampage (see below).

JOBS

The job market continues to be the strong point in the US economy. The US added 225,000 jobs last month, the unemployment rate ticked up to 3.6% from 3.5% due to an influx of new workers, and wages climbed by 3.1% compared to last year. Some of the job gains were attributed to mild weather in January. The three-month average of 211,000 is now trending above the 12-month average of 175,000.

But while jobs across the entire US economy are strong, brick and mortar retailers continue to be hammered, especially department stores. Macy’s announced that it will close 15 stores over the next three years and eliminate about 2,000 jobs.

TESLA

In a move reminiscent of bitcoin or some of the internet highflyers from 1999/2000, TSLA was up by 447% from its June 3rd intraday low to its intraday high on Tuesday (2/4/2020). The stock closed the week down 22.7% from that point. The Company, which has been a favorite of the bears, has turned around investor sentiment from possible bankruptcy, too, according to famed investor Ron Baron, a possible $1 trillion in revenues within 10-years. Currently, Tesla has a free cash flow yield of 0.8%, and at its current market cap, Tesla is selling for $367,000 for each car delivered in 2019, while GM is valued at $6,400 per car, and BMW is at $17,000 per car.

ISM

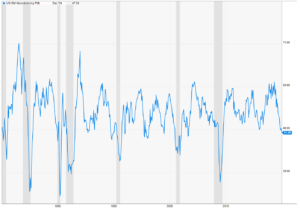

The Institute for Supply Management’s manufacturing index came in at 50.90, back in expansionary territory for the first time since July and up from 47.8 in December. The survey was mostly conducted before the coronavirus outbreak. “The outbreak of the novel coronavirus in China is likely to significantly disrupt activity in 1Q20. The inevitable disruptions to China, as well as potential spillovers to the rest of the world, should become visible starting with the February report,” according to J.P. Morgan economists Joseph Lupton and Olya Borichevska.

TRADE DEFICIT

The US trade deficit fell for the first time since 2013 to $617 billion from $628 billion last year. Exports fell for the first time since 2016, but imports fell even more, obviously due to tariffs. China dropped to third place as the biggest US trade partner, behind Canada and Mexico. A smaller deficit is likely a sign of weaker demand and slower worldwide growth.

IOWA

The primary season officially got underway with the Iowa caucuses on Monday. Unfortunately, it pretty much turned into a disaster due to software problems. Results still are not complete yet, but so far Pete Buttigieg and Bernie Sanders are about tied with each getting about 26% of the delegates.

SCOREBOARD