SCOREBOARD

Week Ending 12/20/2024

MARKET RECAP

- US stocks were down by 2.22%, international stocks by 2.94%, and bonds by 0.66%.

- The Dow ended a 10-day losing streak on Friday, the longest since the 1970s.

- The Fed cut interest rates by 25 points, but Powell’s “hawkish” commentary, even though we thought it was telegraphed beforehand, sent markets into a tailspin, with the Nasdaq and SP500 falling by more than 3% at its low. It was the worst performance by the equity markets on a Fed Day since 2001.

- The 10-year treasury is at 4.54% and is up 34 basis points this month.

- Bitcoin broke 108,000 on Tuesday but is 95,600 as of this writing (Sunday afternoon).

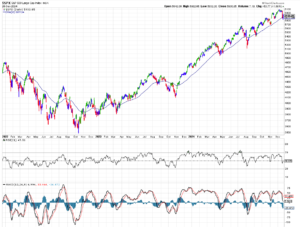

S&P 500

SCOREBOARD

Week Ending 12/13/2024

MARKET RECAP

- The NASDAQ managed a small gain, +0.34%, but the S&P 500 fell by 0.64%. The Dow was down by 1.82% and small caps fell by 2.58%.

- CPI increased by 2.7% year over year, so falling inflation has seemed to stall out. That put pressure on treasury yields; the 10-year increase was 4.4% from 4.15%.

- The overall market is performing poorly. According to Dow Jones Market Data, for 10 straight days, more stocks in the S&P 500 have gone down than have gone up. This is the longest streak since 2000.

- Trump was named Man of the Year by Time Magazine and visited the NYSE to receive the honor. Since the election, Trump has seemed more stable and less bitter, and his visit to the NYSE struck all the right chords and was pretty impressive. Trump emphasized his commitment to fostering a strong economy, promising substantial tax cuts and incentives for domestic manufacturing. He proposed reducing the corporate tax rate from 21% to 15% for companies that produce goods in the U.S. He also highlighted his administration’s focus on increasing oil production to help control inflation and reduce grocery prices. However, there could be the possibility that it might have been one of those high profile that marked the top!

SCOREBOARD

Week Ending 11/29/2024

MARKET RECAP

- The SPX was up 1.06% for the week and 5.96% for the week.

- After Trump threatened a 25% tariff on Mexico, Mexican President Claudia Sheinbaum said she would retaliate. But by the end of the week, all was good; they both said they had a great meeting.

- Investors seem to believe that Trump’s tariffs are a negotiating tool.

- Valuations are sky high, the trailing p/e is about 26, and the Magnificent Seven sells at 30 times forward earnings.

- Core PCE was 2.8% year over year.

SCOREBOARD

Week Ending 11/22/2024

Week Ending 11/15/2024

MARKET RECAP

- Stocks went into reverse this week, the SPX sliding by 2.08% and the Nasdaq by 3.15%.

- While Trump’s initial picks to lead this team were considered solid, his last few seem to indicate he is more interested in generating controversy, than getting things done. Matt Gaetz as Attorney General, Tulsi Gabbard as Director of National Intelligence, and Robert Kennedy for Health and Human Services all worry investors.

- Valuations also are high at about 22x forward earnings.

SCOREBOARD

Week Ending 11/08/2024

MARKET RECAP

- Trump completed a political comeback of historical proportions and won the election, and the Republicans took the Senate and the House simultaneously. That may be a curse because Trump has no excuse now not to pass all of the crazy promises he made during the campaign, which will balloon the deficit to heights way beyond the current out-of-control numbers.

- Stocks loved the Trump victory; US stocks were up by 5.13% for the week, while international stocks were up only 0.21%. The Russell 2000 was up by 8.57%.

- The October ISM Services report had the highest reading since July of 2022, and University of Michigan consumer sentiment had the highest reading in six months.

SCOREBOARD

Week Ending 11/4/2024

MARKET CAP

- US stocks -1.16%, international -0.74%, bonds -0.57%.

- US stocks were down in October by 0.75%, the first monthly loss since April.

- Q3 GDP came in at 2.8% for the first read.

- Payrolls were up only 12k compared to an estimated 100k, but the hurricanes and the strikes probably had an impact. The unemployment rate remained 4.1%. JOLTS openings continue to decline, now at 7.4 million, the lowest since the beginning of 2021.

- ISM Manufacturing of 46.5 was the lowest since June of 2023.

SCOREBOARD

Week Ending 10/25/2024

Week Ending 10/18/2024

MARKET RECAP

- Sixth straight week of gains, US stocks +0.97%, international -0.39%, bonds +0.02%.

- WSJ columnist Peggy Noonan noted in her Friday column that the elected has “reached its Oprah phase, you get a car and you get a car and you get a car.” Both candidates just make promise after promise as if they are running for school president in the 5th grade. Actually, 5th graders are probably more responsible than these two candidates. Both continue the recent tradition of completely ignoring the monster deficit.

- Torsten Slok, Apollo’s Chief Economist, writes that the current forward p/e “at almost 22” implies a 3% annualized return over the coming three years.

SCOREBOARD