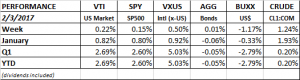

PERFORMANCE

The market made a u-turn mid-week, falling by slightly on Monday and Tuesday and then finishing in rally mode. Overall, US equities were up slightly, +0.22%. Trump’s announcement on Friday that he wanted to cut financial regulations helped the big banks surge in price, and that got equities into the black for the week.

International equities continued to outperform, +0.50%. The US dollar was down and crude was up.

EARNINGS ESTIMATES

Earnings estimates for Q1 dropped by 1.5% during January, from $30.57 to $30.10. That compares to an average decline of 2.3% over the last five years for the first month of a quarter.

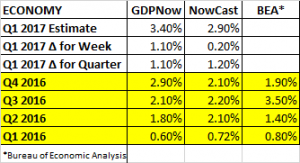

GDP

The GDPNow came out with their first estimate for Q1 growth at 2.3% on January 30th, and it was quickly bumped up to 3.4% on February 1 after positive reports from the Institute for Supply Management (ISM) and the construction spending report from the U.S. Census Bureau. The NowCast forecasts Q1 growth at 2.90%. For Q4, the final GDPNow forecast was for 2.9% growth and the Nowcast was 2.10%.

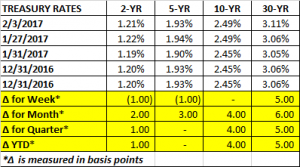

INTEREST RATES

Midweek, the Fed announced in would not raise interest rates at this time. Rates were flat for the week.

JOBS/INFLATION

Nonfarm payroll employment increased by 227k. Private payroll was up 237k and government payroll declined by 10k. It was the biggest gain in six months. But the two previous months were revised down by 39k. The unemployment rate increased by 0.1% to 4.8%, but that was due to an increase in the labor force participation rate, which bumped up to 62.9% from 62.7%. And year over year increase in hourly earnings advanced by 2.5%, down from 2.8% in the prior report.

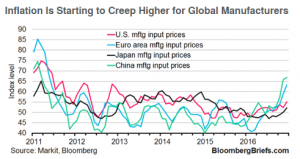

The slight uptick in the unemployment rate and the subdued increase in hourly earnings gives the Fed some more breathing room on increasing rates, for now. But as the chart below shows, manufacturing input prices are rising around the world and that is likely to show up in prices down the road.

Initial claims for unemployment declined by 14k to 246k.

GLOBAL ECONOMY CONTINUES TO IMPROVE

The latest PMI data shows that the global economy continues to improve. The Global PMI reading stands at 52.7, the highest level since February 2014. 85% of individual countries have scores above 50, indicating expansion, the highest level since March of 2014. New orders are increasing, indicating the chance for more growth ahead.

RETAIL

Retailers and those that sell through retailers are a weak spot that might start rippling through the economy. This past week, Under Armour shares dropped 29% on slower sales growth, Ralph Lauren fell 13% and Deckers Outdoor plunged 21% on an earnings miss.