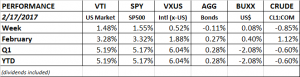

PERFORMANCE

US equity markets continued their advance, adding about 1.5% for the week. The markets are up almost 5% year to date and up about 10% since the election. International markets were up about 0.5% on the week, bonds were down slightly, the USD was flat and crude was down.

The VIX (the volatility index) is at multi-decade lows. The SP500 has now gone 89 days without dropping more than 1%.

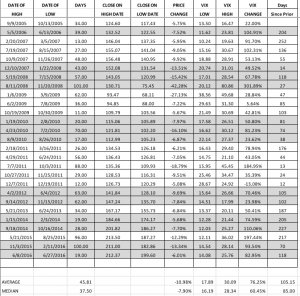

From a technical standpoint, the market is overbought. There all kinds of indicators out there detailing that, but one that we follow is called Wilder’s RSI. This metric is an oscillator that looks at recent price action and turns that data into a number from 0 to 100. The number 70 is often used to indicate an overbought condition. We use a 21-day RSI and it cracked the 70 level this week. Getting north of 70 has been a rare occurrence this decade, and it has sometimes led to a selloff in the market (see the blue vertical lines below).

We are also overdue for some kind of sell off. By our count, it has now been 235 days since the end of the last sell off of greater than 5%. That is the second longest streak since 2005. The longest was 252 days in 2007.

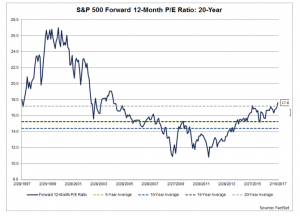

VALUATION

The forward P/E ratio now stands at 17.6. That is the highest level since June of 2004.

ECONOMY/GDP

The Atlanta Fed’s GDPNow model forecasts 2.40% for Q1. That is down 0.30% from last week. The NY Fed’s Nowcast model remained steady at 3.10%. Negative news from industrial production and capacity utilization was offset by positive news from surveys and housing and construction data.

The Conference Board’s Leading Economic Index increased by the most in two years, up 0.6% for January. The six-month rate of change in the LEI was up 1.6%, the most since July of 2015. This indicates a strengthening economy later this year.

Greek Debt Crisis

The next chapter of the Greek debt crisis is on the way. Another bailout program is needed and some European governments are hesitant to give more money to Greece without IMF support. But the IMF won’t help unless Greece commits to a budget to its liking. Something Greece is not inclined to do at this time. If the IMF does not participate, that is considered a signal that the Greek budget doesn’t add up. And that could mean trouble for the Euro.