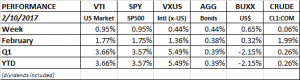

PERFORMANCE

The market continued its relentless pursuit higher, making it 84 trading days without a decline of 1% or more. This despite all the craziness in Washington and around the world. Favorable earnings news, improving global economic data and the hint that a “phenomenal” tax plan is a couple of weeks away are what the market is concentrating on.

US equity markets were up about 1% and international equities less than 1/2 of that. The dollar was up 0.65% and crude was flat.

TAX PLAN

We do not know the details of Trump’s corporate tax plan, but some form of a border tax is a possibility. A border tax would likely negatively impact SP500 earnings, since many of those companies rely on imports. The flip side is that the corporate tax cuts would probably offset the lost income from the border tax. However, the law of unintended consequences could come into play as US companies have built up intricate supply networks that count on the free flows of good into this country without a tax or tariff.

There is also talk of eliminating interest deductibility which would hit earnings.

We do need corporate tax reform but as they say, the devil is in the details.

FOREIGN INVESTORS BACKING AWAY FROM TREASURIES

Foreign investors have been reducing their exposure to US treasuries due to a combination of higher US deficits, more inflation, higher interest rates down the road and the Trump effect. For the United States, less foreign ownership of treasuries, in and of itself, will push interest rates higher.

CHINA

China’s foreign currency reserves have dropped to just under $3 trillion from $4 trillion in 2014. China has been using their reserves to try to keep the value of yuan from falling even faster than it has. Worried about more depreciation, Chinese citizens have been trying to move currency overseas, which of course leads to even further depreciation. There is always the possibility that at some point the Chinese government will halt their efforts to prop up the yuan and let it find its natural level. A big drop in the yuan could lead to a market selloff as it did at the beginning of 2016.

One positive note in relation to China is that Trump has backed off on some of his saber-rattling in the last week and even wrote a letter to the Chinese leader promising a “constructive relationship.”

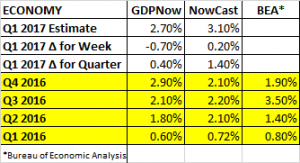

GDP

The Atlanta Fed’s GDPNow Q1 estimate fell by 0.70% to 2.70%, but the NY Fed’s Nowcast increased their Q1 estimate to 3.10% on positive news on imports and exports.

Jobless Claims

Initial claims for unemployment continue to fall hitting the lowest level since November of 1973 at 234k.