The US markets continued their decline falling 3.12% (VTI) for the week. Overseas markets dropped 2.32% (VXUS).

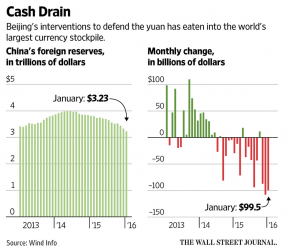

Randall Forsyth writes in Barron’s that foreign countries in need of cash, due to the decline in the price of oil, or domestic economic problems (like China), might be tapping into their investments to free up cash for use at home. That might be impacting equity markets around the globe.

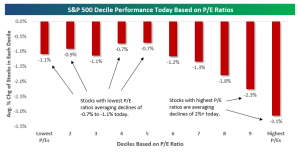

High p/e stocks led the retreat during the big 2%+ sell-off on Friday. LinkedIn (LNKD) dropped about 50%. According to Bespoke, stocks with the lowest p/e’s had average drops from -0.7% to -1.1% while those stocks with the highest p/e’s dropped an average of 1.2% to 3.1%. This analysis was based on splitting the market into deciles and calculating the average declines of the 5 lower deciles and then calculating the five higher deciles. The market has favored growth stocks over value the last couple of years but Friday may mark a change in that sentiment.

EARNINGS

So far 63% of SP500 companies have reported earnings for Q4. According to Factset, 70% have beaten the earnings mean estimate and 48% have topped the sales mean estimate. The blended earnings decline is -3.8%. Assuming earnings end up in the negative, this would be the first time since the first three quarters of 2009 that earnings have declined three quarters in a row. 57 companies have lowered EPS guidance and 14 have raised guidance. 12-month estimated earnings are now $124.29, putting the SP500 at forward p/e of 15.12. Revenue growth has been led by the telecom and healthcare sectors. Energy had the largest decline in revenue.

EMPLOYMENT

Employment numbers released Friday were generally favorable. The unemployment rate fell to 4.9% from 5.0% and a 151,000 new jobs were created in January. The labor force also grew for the third consecutive month. Long-term unemployment hit a new post-recession low. Wages and hours worked improved. On the downside, jobless claims were 285,000 which was higher than expected for the fifth time in six weeks. However, while 285 is greater than some of the low jobless claims numbers we were seeing a few months back, it is less than almost all of the other reports dating back to 2005.

PMI

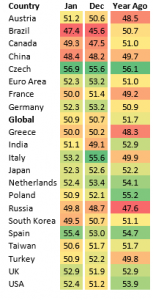

Markit released its Purchasing Manager’s Index for various countries around the world. A PMI reading greater than 50 indicates growth. Of the 20 countries listed, 13 had a PMI greater than 50, two had a PMI equal to 50 and five had a PMI less than 50. Ten of the twenty countries had a month over month improvement. Looking from a global perspective, the PMI improved to 50.9 from 50.7. So growth continues on a global basis at a slow rate.

CREDIT CONDITIONS

There was a negative report this week indicating that credit conditions are tightening. The Senior Loan Officer Opinion Survey showed that credit standards for commercial and industrial loans are starting to tighten. There was also a decrease in these types of loans. In the past, that has been a leading indicator of a recession. However, other types of loans are showing positive growth rates.

ENERGY

The Department of Energy announced that inventories continued to increase for oil, gasoline and distillates. At the same time, demand for oil and gasoline increased. That set up a short squeeze rally that moved the WTI up by 10%. That rally turned the market around from a 1.61% loss to a 0.60% gain on Wednesday.

DOLLAR

The other big news on Wednesday was a massive drop in the dollar. It was the largest decline in the Bloomberg USD index since March 18, 2015.

PRODUCTIVITY

Productivity fell at a 3% annualized rate in Q4 according to the Advance release. Employee compensation increased. The economy had higher wages and flat output resulting in the lower productivity. This could be a bad sign for corporate profits.

CHINA

China has been burning through their foreign-exchange reserves, dropping to a 3-year low in January. The government is in a battle with speculators and hedge funds that are betting on a decline in the yuan. China want to maintain a stable currency. For now, their efforts have kept the yuan stable over the last few weeks, the question is how long they can hold out.

SUMMARY

There was plenty of news on the negative side this week. But most every respected economist still does not see a US recession in the near term, although the percentage chances are increasing. The market stalled right at its resistance level of about $95 on the VTI. However, valuations are reasonable. The market is selling at about 15 p/e based on forward earnings and the spread between the dividend yield on the SP500 versus the 10 year treasury bill is at its highest since 2012.