It was another tough week in the equity markets. The US market (VTI) was off 0.94%, the SP500 (SPY) -0.70% and the international markets (VXUS) -3.05%. The aggregate bond index (AGG) was up 0.41%. The market did rally on Friday, as the SPY advanced 2.06% on higher energy prices, better retail sales, and insider buying at JP Morgan.

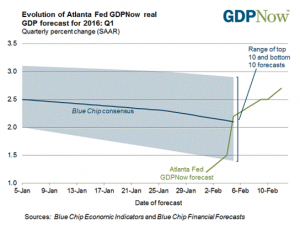

For the year, the SPY is down 8.45% and it is off 12.58% from its high on May 21, 2015. The market is in a tug of war over the probability of a recession. On one hand, declining equity markets point to higher probabilities of recession, while hard economic numbers point toward continued slow growth. The most recent GDPNow forecast, released by the Atlanta Fed on February 12th, shows Q1 growth at 2.7%. The estimate has increased three weeks in a row and it is up from the 2015 Q4 estimate of 1% growth. Employment numbers are also solid and we had a good retail sales report (see below).

Whether or not the US enters a recession is important in determining possible implications for the market. According to Ned Davis Research, the average loss on the MSCI ACWI international index when the US and the global economy is in recession is 45.2%. But when the global economy is in recession but the US isn’t, the loss has been 16.8%. At the low on January 20th, the SPY was down 15.22%. The ACWI was down 17% from its high on that date. So if there is a recession overseas that the US escapes, a lot of the downside might already be in. As it is, growth around the world seems to also be advancing slowly.

Looking at the SP500, the median drop in a bear market during a recession has been 29.7%. But the median drop in a bear market during an expansion and within a long-term market uptrend has been much less, 19.3%.

WORST START EVER

Through February 11, the SP500 was down 10.96% year to date. That makes it the worst start ever since the index began in 1928. The previous low was in 1948 when the SP500 was down 9.22%. The market finished 1948 up 9.43% from that point.

RETAIL SALES

The January retail sales report came in with good numbers. Excluding autos and gas, sales were up 0.4% and they were up 3.4% year over year. December numbers were also revised higher. Consumers might be finally starting to spend their gas savings “dividend.”

EARNINGS

According to Factset, 76% of SP500 companies have now reported earnings. 69% have beat the mean estimate and 49% have topped the sales mean estimate. The blended earnings decline is 3.7% for Q4. 68 companies have reported negative EPS guidance and 17 guided to the upside. The 12-month forward p/e is an even 15 based on the Friday close (1864.78/124.25).

NEGATIVE INTEREST RATES

Fed Chief Janet Yellen was in front of Congress this week. She said a US economic contraction is not imminent. She also said that due to economic uncertainty around the world, the Fed would slow, but not halt, planned interest rate increases. When asked about a negative interest rate scenario, Yellen said that would be a remote possibility. NY Fed President William Dudley said that the debate about negative rates is “extremely premature….the US economy is in quite good shape.”

BANKS

Banks have been hit hard this year. The Financial Select Sector ETF (XLF) is down 14%. Financials are down due to worries about China, lower interest rates, lower energy prices and the spillover from problems in European banks. Credit default swap spreads are increasing in price on all of the major money center banks, but they are not close to the peaks seen in the last crisis. Mike Mayo, a research analyst at CLSA Americas, a long-time bear on the sector, has turned positive on the banks due to their strong balance sheets. In response to the low prices, Jamie Dimon, CEO of JP Morgan, bought about $25m of shares in his Company this week.

SP500 YIELD

The SP500 dividend yield now (2.33%) has a 59 basis point advantage on the 10-year treasury (1.74%). This is the widest spread since 2012. Prior to 2009, we went about 50 years when the SP500 yield was less than the 10-year treasury. According to Bespoke Investment Group, since 1929, there have been five periods where the differential was 50 basis points or more. If an investor bought the index the next day and held for one-year, the returns would have been -19%. +31%, +45%, +32% and +24%. The only negative return was in 1929.

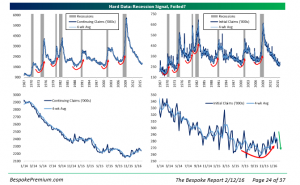

JOBLESS CLAIMS

Initial jobless claims came in at 269,000. That was down from last week’s reading of 285,000 and lower than the 280,000 estimate. Continuing claims also declined. This is another signal that fears of a recession, at least for now, are overstated. The JOLTS report shows that layoffs are at lows and employees are feeling comfortable enough to leave their jobs, both signals of a strong job market. This should translate into continued wage gains.

US BUDGET

The US budget came in at a +$55b for January, which was the best January performance in 10 years. The number is also a positive in confirming that the economy is hanging in there. In the last quarter of 2007 and the first quarter of 2008, the balance went negative, indicating economic trouble ahead.

POLITICS

Barron’s cover story this week was titled “Trump, Sanders – Are they killing the market.” We spoke about this in our 2015/2016 Market Review. But as we get closer to the election, and if the possibility of either Trump or Sanders becomes realistic, it could have negative consequences for the market. Of course, either candidate would have to get their radical policies through Congress, something that would be unlikely. Still, some of their proposals would simply be terrible for the United States and the world.

SMALL BUSINESS

The NFIB Small Business Optimism survey fell to its lowest level since March of 2013.

GOLD

Gold has been off to the races in a safe haven trade. The GLD was down 46% from its September 2011 high to its December 2015 low but has since rallied 18%.