The market picked up where it left off on Friday and put together back to back +1% gains on Monday and Tuesday. For the week, the overall US stock market was up 3.12% (VTI), the SP500 (SPY) was up 2.87% and the aggregate bond index (AGG) was even. The market was led by up by stocks with heavy short interest.

This downturn has been marked by a series of lower highs and lower lows. The SPY, which closed at 192.00, will have to get north of 194.60 to set a higher high to possibly signal a change in trend.

RECESSION THREAT

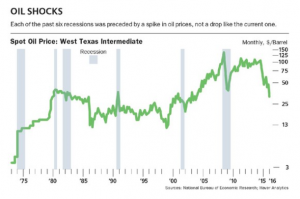

Gene Epstein writes in this week’s Barron’s about the threat of a recession. In each of the six previous recessions, there was a spike in crude prices before the onset of a recession. There is no case of a recession when crude prices were falling as they are currently.

Of course, the threat in this case is that falling crude prices will lead to a wave of defaults impacting banks and high yield bonds. According to Carsen Valgreen of Applied Global Macro Research, these types of loans amount to less than 4% of the banks’ total loan book. So even if half of these loans go bad, it should not be enough to set off a banking crisis.

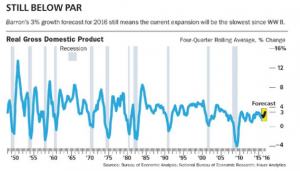

The US economy continues on its slow growth path, while economic conditions might be on a more slippery footing overseas. According to Michael Lewis, economics chief at Free Market, “in the modern era, there is not a single recession that can be traced to foreign economic woes.”

Epstein concludes that we should be able to avoid a recession, albeit with subpar growth.

OIL

The market was helped by some talk that OPEC members were in discussion to limit production to get the price of oil under control.

HOME BUILDER SENTIMENT

Home builder sentiment fell to its lowest level since May. Time will tell if we have seen the peak in sentiment. In the past, peaks in home builder sentiment often preceded a downturn in the overall business cycle by at least two years.

LEADING ECONOMIC INDICATORS

The Leading Economic Index fell 0.2% in January, marking the second straight decline. Four of ten LEI components declined. But the six-month smoothed LEI number increased. An alternate leading index, made up of the difference between the Coincident Index and the Lagging Index, increased by 0.2%.

JOBLESS CLAIMS

Jobless claims fell again, to 262,000. This is the lowest level in three months.

INDUSTRIAL PRODUCTION/CAPACITY UTILIZATION

Industrial production was up 0.9% in January. This was the first gain in four months and the most since November 2014. Manufacturing output was up 0.5% and the capacity utilization rate increased to 77.1% from 76.4%. These increases show signs that the industrial and manufacturing sector are beginning to stabilize, thereby reducing the near term risk of recession.

HOUSING

Housing starts dropped 3.8% in January. Snowstorms in the northeast might have impacted the number.