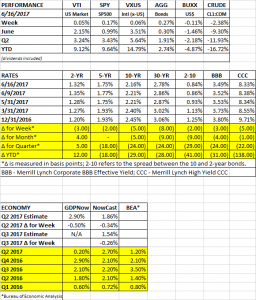

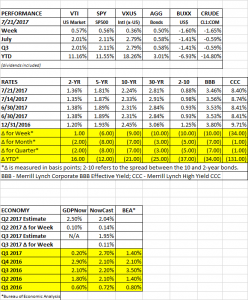

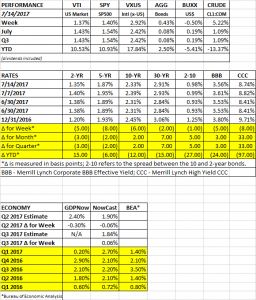

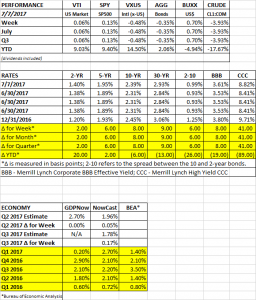

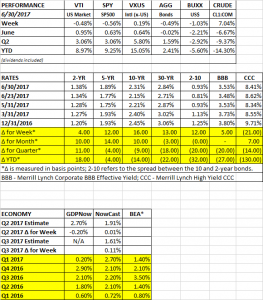

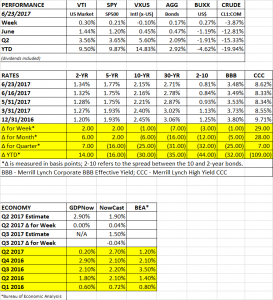

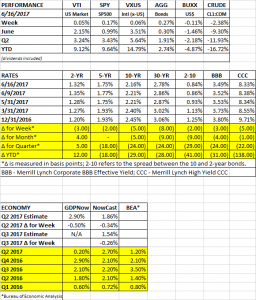

PERFORMANCE

The equity markets had small increases. The overall US market was up 0.05% and international markets were up 0.06%. But don’t let the flat results fool you, there was lots of news including Amazon buying Whole Foods, a change in leadership at GE, a Fed interest rate hike, and a gun attack on Republican baseball players.

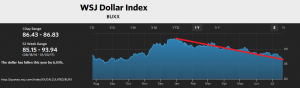

Bonds increased by 0.27% as interest rates dropped, the dollar fell slightly and oil dropped another 2.38%.

AMAZON

Amazon announced its proposed purchase of Whole Foods on Friday for $13.7b. And based on every comment by the “experts”, all the competitors might as well just close up shop now and liquidate because Amazon is just going to roll them over. They may be right given what Amazon has done to the retail sector. Kroger dropped 10%, Costco down 7% and Wal-Mart down 5%. But I would give sharp operators like Wal Mart, Costco, Target, and others some credit. The one likely winner for sure will be the consumer. Because the supermarket space is now going to become even more competitive than it was before, with just about everyone pouring more dollars into advanced technology, fresher products, and probably lower prices. And the competitive pressure on prices will be forced down the entire supply line. The consumer will be the big winner.

GDP

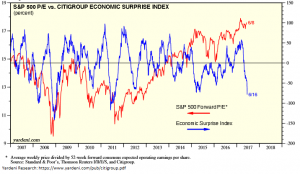

The Atlanta Fed’s GDPNow model is forecasting Q2 growth at 2.9%, down from 3.0% last week. A slowdown in residential housing contributed to the lower estimate as the number of annualized housing starts hit an eight-month low. That, along with several other indicators, such as new hires, lower inflation and weaker consumer sentiment have some worried that the economy is beginning to roll over. The lower numbers are reflected in the chart below, which compares the Citibank Economic Surprise Index versus the p/e on the S&P500. The Citibank index charts actual results versus expectations. When numbers are coming in less than expectations, the chart is headed down (as it is now). Normally, the S&P 500 p/e and the index roughly track each other, but recently there has been a big divergence, with the Citibank Index falling sharply while stocks remain elevated. The economic numbers have not been terrible in absolute terms (based on recent history), but they have not been meeting expectations. So, is the problem that the expectations were too high? Maybe a result of the post-election optimism. Or is the problem that this is indeed an economy where growth is now beginning to head in the wrong direction? We have been through this before over the last several years and the economy has rebounded.

This economy cannot get any serious traction north of 2% growth, and for now, we continue to believe that is the continued path for the near term. Slow growth in and around 2%.

FED

As expected the Fed raised interest rates by 1/4% and laid out plans to shrink its $4.5 trillion balance sheet. The Fed also said it plans to raise interest rates one more time this year if the economy performs in line with expectations. To begin with, the Fed will reduce its balance sheet by letting $6b in Treasury securities and $4b in mortgage bonds mature without being reinvested. Each quarter, the amounts would increase. The program would max out at $30b per month for Treasury’s and $20b for mortgage-backed securities. The balance sheet reduction could begin soon if the economy continues to perform.

OIL GLUT

Crude oil fell 4% on Wednesday on new reports regarding inventory. Crude inventory dropped by 1.7 million barrels, significantly less than the consensus forecast of 2.6 million. Gasoline inventories increased by 2.1 million barrels, much more than the estimated decline of 700,000 barrels. According to the International Energy Agency (IEA), oil inventory in the Organization for Economic Cooperation and Development (OECD) countries increased by 18.6 million barrels, and now stand at a higher level than when OPEC cut production last year and are 292 million barrels higher than the five-year average. The IEA expects US oil production to increase 5% this year and 8% in 2018. Overall, non-OPEC production should increase by 1.5 million barrels per day in 2018 versus an expected rise of 1.4 million barrels in demand.

SCOREBOARD