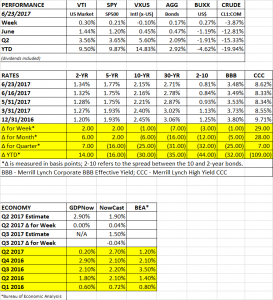

PERFORMANCE

The US equity markets were up about 0.30% while international markets fell slightly, down 0.10%. Health care had a big week, up 3.7%. A new Senate health plan would limit regulation in the sector.

The action continued to be in oil, where prices were off another 3.97%. The price of crude is now down to about $43/barrel. The consensus as recently as a couple months back was that crude would stay in the $50 range and slowly drift higher, but inventories have now been increasing for several weeks and the price has been going into reverse. There was hint that the high yield markets are starting to get nervous, the Merrill Lynch High Yield CCC Index jumped 29 basis points last week while the rest of the bond market was close to flat.

OIL

A big drop in oil prices at the beginning of 2016 contributed to the sell off at that time. But supposedly the weaker hands have gone bankrupt and the remaining companies have cleaned up their balance sheets and are in better shape. Time will tell if that turns out to be the case but it is worth watching if a divergence between high yield bonds and equities continues. More specific to the sector, oil and gas high-yield bonds are down 4% this month, according to ICE Data Services, and some of the weaker debt is down 26%.

Another knock-on effect of the lower oil prices is that it will cause the energy sector to have lower profits, and that might lower analysts projections for overall profits going forward. Investors have been counting on growing profits to power the recent market rally, but if oil continues to fall profit revisions are probably on the way.

YIELD CURVE

Investors are concerned about the flattening yield curve. A flattening yield curve normally signals slower growth. An inverted yield curve often signals recession. But before you get an inversion you start with a flattening. One argument though, is that “this time is different”, because of the suppressed yields worldwide, especially in Europe and Japan. Negative interest rates overseas have dramatically increased demand for US treasuries and thus pushed down yields further out on the curve leading to a flatter curve. Remember though that “this time is different” are often the most dangerous words in investing. The difference between the yield on the 10-year bond and the 2-year bond has flattened by 44 basis points this year and currently stands at 0.81%. For now though, the economy appears to be continuing to move along at the slow motion rate we have become accustomed to.

SCOREBOARD