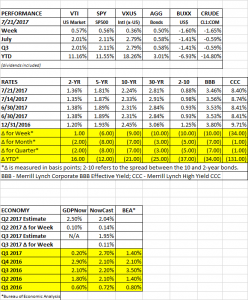

PERFORMANCE

It was another good week for investors as equity and fixed income markets were generally up by about 1/2%. The US markets increased by 0.57%, international +0.36% and the bond aggregate +0.50%. The US dollar fell by 1.60% and crude dropped by 1.65%.

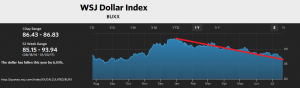

The markets have been helped by strong earnings, which in turn have been helped by a lower dollar. The dollar is now down about 7% on the year. A lower dollar provides a tailwind to earnings. According to Dubravko Lakos-Gujas from JP Morgan, S&P500 earnings increase by about 1% for every 2% decline in the dollar. Overall, 19% of S&P 500 companies have reported earnings this quarter, and they have come in 7.8% above estimates (per FactSet).

Interest rates generally declined but at the short-end of the curve, they increased. The 5, 10 and 30 year bonds all had lower yields. But the two-year was up by 1 basis point and the 3-month yield increased by 12 basis points. Bond investors are worried about the up-coming battle over the debt ceiling, probably sometime in October, 3-months away.

POLITICS

While the market continues to advance, the political environment continues to deteriorate. Special Counsel Robert Mueller expanded his investigation into Trump’s Russia connections, including historical personal transactions. White House Press Secretary Sean Spicer resigned and Trump criticized his attorney general. The Republicans cannot pass a healthcare bill and cannot even figure out how to take a vote on one. That was just this week.

ECONOMIC

The Conference Board’s Leading Economic Index was up by the most since December of 2014, increasing 0.6%. A strong report on building permits led the way.

Initial jobless claims fell to 233,000. Down 15,000 from last week.

SCOREBOARD