HIGHLIGHTS

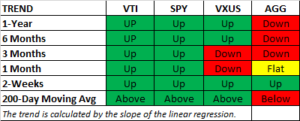

- Stocks take a major hit as US equities fall by 5.66% and international equities drop by 3.55%. US stocks are down 2.62% for the year.

- The market is selling right at its 200-day moving average and close to the lows from February.

- LEI is up again. Strong PMI reports and low initial claims for unemployment.

- More disarray at the White House.

- Trump and China both announce new tariffs.

- Facebook data was misused in the 2016 election as calls for regulation increase.

- A government funding bill totals $1.3 trillion and adds more to the deficit.

- LIBOR has been increasing at a rapid rate.

- The Citi Surprise Index for the Eurozone is at a two-year low.

- FHA delinquencies increase.

MARKET RECAP

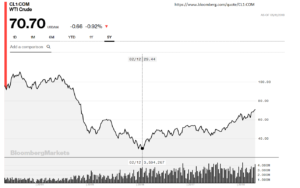

It was a brutal week for the markets as US equities fell by 5.66%. The Nasdaq Composite dropped 6.5%. International stocks dropped by 3.55%. US stocks are now down 2.66% for the year. Even though treasuries dropped a few basis points across the curve, the aggregate bond index also fell, by 0.08%. Crude oil rallied by 5.68%.

Market technicals have not been good. On Thursday and Friday, stocks opened close to their high for the day and then sold off and finished very close to their low for the day. The market is now at its 200-day moving average and close to breaking the lows from the February sell-off.

One bright point is that the SP500 is now selling as 16.4 times 2018 estimated earnings, a more reasonable value.

There are lots of reasons to explain the fall. We explain the good and the bad below.

THE GOOD

Economic reports continue to show strong growth ahead. The Conference Board’s Leading Economic Index (LEI) was up by 0.6% in February and it was the fifth consecutive month with an increase. Eight of the ten LEI components made positive contributions and all indicators posted gains over the past six months. The six-month rate of change of rose to 4.0%, its fastest pace since March of 2011. Year over year, the LEI was up 6.5%, the most since July 2014.

The Markit U.S. flash Manufacturing Purchasing Managers Index (PMI) increased by 0.4 points to 55.7, its highest level in three years. The flash Services PMI fell 1.8 points to 54.1, still in expansion mode. New orders were close to a three-year high.

Initial claims for unemployment insurance were up by 3,000 last week to 229,000 and the four-week average of claims was 223,750, close to its lowest level since 1973, as labor markets.

THE BAD

The market is being hit on multiple fronts, many self-induced.

THE WHITE HOUSE

We wrote about this last week. It is hard to ignore the turnover and complete disarray in the White House. Trump’s primary outside lawyer, John Dowd, resigned. A clear indication, not necessarily that Trump is guilty, but something just is not right about working for the White House. Then Trump fired National Security Council Chief General H.R. McMaster and replaced him with John Bolton. Bolton is considered an extreme hawk. These changes are on top of an avalanche of other changes in prior weeks and indicate serious problems and mismanagement in the Executive office.

TARIFFS

Trump announced that he would impose tariffs on about $60 billion of Chinese imports, in addition to the already announced tariffs on aluminum and steel. China responded announcing it would levy about $3 billion in tariffs on U.S. goods. We have the beginning of what could turn into a trade war. That is what is the market fears.

The U.S. does have legitimate complaints about the way China, and some other countries handle trade. China has stolen intellectual property and forced technology transfer, among other violations. But the government should be doing everything possible to negotiate free trade in China and around the world, to eliminate restrictions, and let companies compete on a fair plane. Work to open markets, not close them.

The question is this, is the tariff plan a negotiating tactic by the Trump administration to force open Chinese markets? Or is it the start of a much bigger and deeper effort to stifle imports, close markets and to bring down the trade deficit. If it is the ladder, and if this escalates into an all-out trade war, the world is in for some darker times.

Even if it does not turn into an all-out trade war, tariffs can impact the intricate supply chains that businesses have built up over decades. Changing supply chains that will result in less efficient commerce translates to lower profits, and lower profits usually mean lower equity prices. So far, the overall tariff numbers being bandied about is not that significant, but for now, the real damage can be the psychological spillover effect.

FACEBOOK

The week got off to a bad start on Monday when it was revealed that Facebook data was utilized to sway voters in the 2016 election. Apparently, this is news. Cambridge Analytica, a vendor of the Trump campaign, used data that it was not supposed to have in their efforts to help elect the President. Millions of users had their privacy data violated, leading to calls from across the spectrum (political and business) for regulation in the social media space and especially at Facebook. Facebook fell x% on Monday to lead the market down and finished off by 14% for the week.

FUNDING THE GOVERNMENT

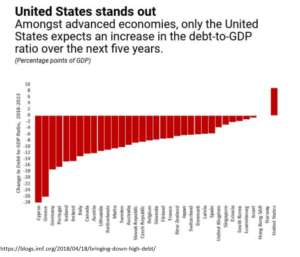

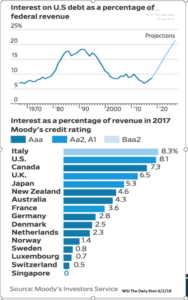

Trump signed a 2,232-page bill that will fund the government through October. The bill authorizes the spending of $1.3 trillion and further blows up the deficit. This, at a time of economic expansion when the budget deficit should be declining. More deficit spending means a larger supply of treasuries, on top of the already expanded supply to fund the roll off from Fed’s balance sheet. More bond supply requires higher interest rates to attract investors, and higher interest rates results in competition for investing dollars with equities, a negative for the stock market.

LIBOR/FED

On Wednesday, as expected, the Fed raised rates by a quarter point to between 1.5% and 1.75%. However, the interest rate news that was more troubling involved the London Interbank Offered Rate (LIBOR). Libor impacts borrowers worldwide and has been increasing at a rapid rate, now at 2.285% up from 1.69% at the end of 2017. Higher libor costs will flow directly to the bottom line and especially impact companies that are levered up or operating on tight margins (see our commentary last week on the danger of debt). Libor’s sharp rise is due to (1) the Fed roll off, (2) repatriation of cash from overseas, (3) share buybacks and (4) economic tension around the globe from the US tariffs and the threat to the global trading system. Banks were hit particularly hard this week, as rising interest rates on the short-end and falling rates on the long end can begin to squeeze margins.

EUROPE

Economic reports have been coming in less than expectations recently in Europe. That might be due to more optimism than was warranted. The Citi Economic Surprise Indicate for the Eurozone is now at its lowest level in the last two years.

DELINQUENCIES

The FHA delinquency rate increased by 0.39% to 9.41%, excluding the areas impacted by hurricanes. This should not be happening when the economy is supposedly improving and suggests credit terms have been too easy.

SCOREBOARD