HIGHLIGHTS

- US equities were up by 2.5%.

- Mild CPI report.

- There are more job openings than unemployed, first time ever.

- Oil prices continue to rise.

- But there are signs that growth is beginning to slow globally.

MARKET RECAP

It was almost like the good old days (of 2017), the market shrugged off negative news and marched steadily higher. US equities were up 2.5% and international stocks were up 1.4%. US stocks are now up 2.8% for the year. Bonds were flat.

The chart below, from John Murphy at Stockcharts.com, shows that economically sensitive transports have recently been outperforming utilities, a positive technical sign.

Financials have also broken out of a recent consolidation range to the upside. Markets were helped by a mild CPI report. The index was up by 0.2% in April and the core CPI increased by only 0.1%. Total CPI is now up 2.5% year over year and the core is at 2.1%.

JOBS

The Labor Department reported that there were a record 6.6 million job openings in March. That is enough so that theoretically, every unemployed person could have a job, the first time that has ever happened. Of course, skill and location mismatches make that impossible. But it is an indication of a continued strong job market.

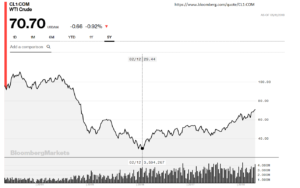

OIL PRICES ON THE RISE

Oil prices have continued to rise, outpacing analyst estimates, as production cuts by OPEC have reduced inventory levels and Mideast tensions increase. Prices broke the $70 barrier.

SIGNS OF SLOWING GLOBAL GROWTH

Capital Economics estimates that export growth in China fell 2% in April, the largest drop in nine months. Copper prices are down 6% year to date, copper is a bell weather for growth in Asia. And purchasing managers’ indexes for manufacturing, while still in expansionary mode, have declined from peak levels in the US, Europe, China, Japan and South Korea.

SCOREBOARD