HIGHLIGHTS

- US equities fall by 1.14% but bonds rally.

- The yield curve flattens.

- Mayhem continues in the White House.

- Inflation is at bay for now, economic reports were mixed.

- Two high profile bankruptcies.

MARKET RECAP

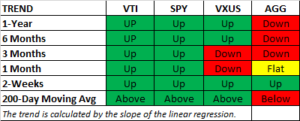

US equities fell by 1.14% and international stocks were down 0.61%. The SP500 closed the week at 2752.01, just about halfway between its closing high and low for the year. Bonds managed a 0.31% rally. The yield on the 2-year note increased by 4 basis points but the 10-year and 30-year yield fell by five and eight basis points, accounting for the increase in bond prices. That means the yield curve has begun to flatten again and is only three basis points away from where it started the year (looking at the difference between the 10-year and the 2-year). Bond prices have begun to stabilize, and for the first time in a while, the trend is either up or flat on 2-week and one-month basis, instead of down across the board.

MAYHEM IS EVERYWHERE

Mayhem, you can find it in every State Farm commercial and in the White House. Chief of Staff John Kelly was rumored to be out, but a supposed truce will keep him temporarily in place. Word is that General McMaster, the national security adviser will exit soon. Secretary of State Rex Tillerson was terminated via a Tweet during the week, to be replaced CIA Director Mike Pompeo. Gary Cohen, who ran the National Economic Council, left last week opening the door for Larry Kudlow. That is on the human resource side.

Special Counsel Robert Mueller issued a subpoena to the Trump Organization, demanding information about Russia. A former consultant misused Facebook data on millions of citizens. Infighting over tariffs continues.

This is supposedly the preferred management style of the President. But he might want to consider the consequences, Republicans continue to lose seats they should be winning, including this week in Pennsylvania where Democrat Conor Lamb won a special election in a district that Trump won by 20 points last year, despite personal campaigning by Trump.

ECONOMY

The CPI numbers came in as forecast at a reasonable 0.2%, keeping the inflation scare at bay for now. Housing starts and building permits were less than estimates, but manufacturing data was better. Employment reports continued strong, initial claims for unemployment were a low 226,000 and the JOLTS Job Openings survey hit a new record high.

The Atlanta Fed’s GDPNow model continues to fall, now at 1.8% growth for Q1. And the NY Fed’s Nowcast is at 2.73% estimated growth. The slowdown in growth estimates has not been felt by small business owners, the NFIB Small Business Optimism survey rose to 107.6, the highest reading since September of 1983 and the third highest reading ever.

BANKRUPTCIES

The poison of high debt often turns deadly, and that has been the case with a couple of high-profile companies this past week. iHeartMedia (IHRT), formerly Clear Channel Communications, filed for Chapter 11 bankruptcy burdened by $20 billion in debt. IHRT was loaded up with debt by private equity firms Bain Capital and Thomas H. Lee Partners when they bought the firm in 2008.

Toys ‘R’ Us, already in bankruptcy, announced they would close or sell their remaining stores. It is the end of an era for what was once an American retail icon. Toys were taken down by multiple factors, but you can count Amazon and a balance sheet loaded with debt as the main reasons. KKR, Bain, and Vornado paid $6.6 billion in 2005 for the chain in a deal financed primarily with debt. Toys ‘R’ Us was spending more than $400 million per year to cover its financing costs. “These substantial debt service obligations impair the company’s ability to invest in its business and future. As a result, the company has fallen behind,” CEO Dave Brandon previously told the bankruptcy court.

As interest rates rise, there will be more stories like these. Years of artificially low-interest rates and easy money have resulted in poor business decisions and companies that are hanging on by a thread, encumbered with high debt. Ultimately, the economy and productivity should benefit from the process of creative destruction, but there will be disruptions along the way.

SCOREBOARD