MARKET RECAP

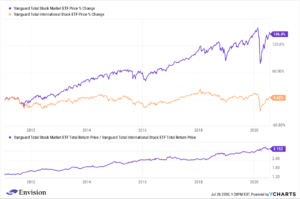

The S&P 500 completed the most improbable of comebacks by hitting a new high on Tuesday and then closing on Friday at another high, up by 0.73% for the week. A combination of massive government stimulus and hopes for a quick recovery brought the benchmark to a new record from being down 35% on March 23. The previous peak, on February 19, to the new peak Tuesday, was only 126 trading days, making it the fast recovery from a bear market ever.

One possible note of worry is the negative divergence in the advance-decline line of the S&P (the green line) versus the index (the blue line), indicating the rally is being propelled by fewer and fewer stocks. Traditionally, that is considered a warning sign. But the divergence may not be long enough to mean anything at this time.

Tech stocks have led the way during the market comeback, the Nasdaq is up 26.1% this year. And Apple and Tesla have led tech. Apple is up 71% for the year and was up 8% this past week., its market cap now exceeds $2 trillion. Tesla was up 24% for the week. 24% for the week, which is crazy and is now up 800% over the past year. Tesla is valued at about $1 million per vehicle delivered. Compare that to GM which is valued at $10,000 per vehicle delivered.

Both Apple and Tesla apparently are being helped by stock splits planned for later in the month. Apple is set to split 4-for-1 and Tesla 5-for-1. Nevermind that a stock split does not confer any new value in the shares, but that doesn’t seem to matter. This feels like one of those moments in history when historians look back and say this was a signal of an out of control mania.

Or maybe it isn’t. Tesla obviously has many fans including Gary Black, former CEO of Janus Capital Group, Black argues Tesla only sells at 65x 2022 earnings in line with Amazon (53x), Lululemon (58x), ServiceNow (63x) and Salesforce (58x), all companies with a lower growth potential than Tesla. As for Apple, Dan Ives of Wedbush Securities says that “We still believe many on the Street are underestimating the massive pent-up demand around this supercycle for Apple [iphones]”.

Despite the rally, many investors think it makes no sense at all, at least in comparison to the fundamentals, and attribute the higher prices to a Fed gone wild with stimulus, historically low-interest rates, an expected Covid vaccine, and a hoped-for fast recovering economy.

At least one area of the economy is booming, which is housing. The Home Builders’ housing index came in at 78 in August, matching the highest reading in the index’s 35-year history. Low-interest rates and a shift to suburban living are driving the index higher. Housing starts were up by 23% in July, the best monthly advance since October of 2016. Revenue at Home Depot was up by 23% and at Lowes by 30% in Q2.

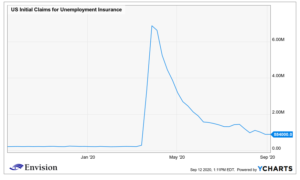

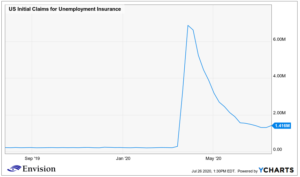

The strong housing reports ran counter to most of the other economic measures last week. Weekly jobless claims rose back above one million, and the Fed indexes that measure manufacturing activity in New York and Philadelphia both came in lower than expected.

COVID

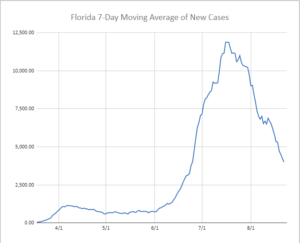

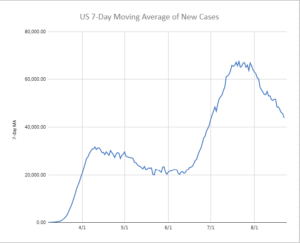

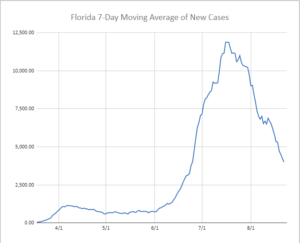

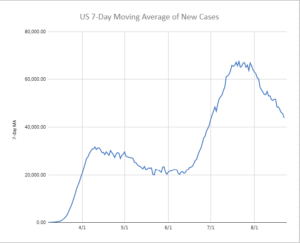

Covid numbers continue to decline in the US and hotspots like Florida, at least for now, and are following a bell chart pattern. Past pandemics have seen a second surge in cases in the fall and early winter, but for now, the trends are good.

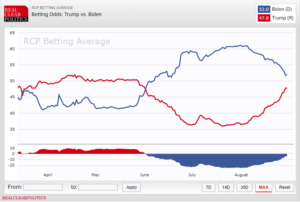

ELECTION

The Democrats made it official and nominated Joe Biden for President and Kamala Harris for Vice President. The Republicans are up next.

SCOREBOARD