SCOREBOARD

Category Archives: Uncategorized

Week Ending 4/2/2021

MARKET RECAP

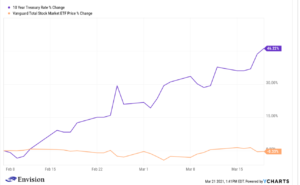

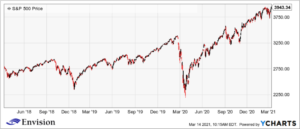

The first quarter closed on Thursday. US stocks registered a 6.5% advance followed by international stocks at 4.5%. US bonds fell by 3.6% due to the fast run-up in interest rates. The yield on the 10-year treasury increased by 81 basis points or 89% during the quarter. Bitcoin just about doubled. High-interest rates, and more acceptance of bitcoin as an alternative to gold, impacted the yellow metal, which fell by 10.3%. The commodity oil was the leader for the second quarter in a row, up by 22.3%.

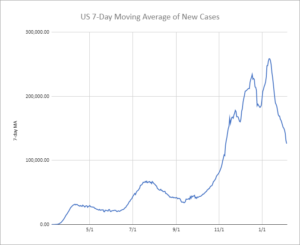

The economy received excellent news on the job front as hiring surged in March. Job increased by 916,000 during the month and the unemployment rate fell to 6%. Infections have turned slightly up in the last couple of weeks, but they are way down for a few months ago, and as more and more Americans get vaccinated, consumer confidence is increasing with the feeling that the end of the pandemic is near. The surging jobs numbers, along with positive momentum in the economy, reenforced the question of the need for the recent $1.9 trillion stimulus bill.

Biden announced the first part of his $2.3 trillion infrastructure plan, to be spent over 10-years. It includes $600 billion for traditional infrastructure projects like roads and bridges. Then there is $374 billion for broadband access, modernizing the electric grid, clean energy, and electric vehicles. $480 billion for manufacturing and research and development. And $500 billion for caregivers and workforce development. The plan would be financed by higher corporate taxes and Biden claims the plan would pay for itself within 15-years.

Hedge fund Archego imploded this week. The fund had $10 billion under management but market exposure of $30 to $100 billion. The fund was brought down by excessive leverage and concentrated positions.

SCOREBOARD

Week Ending 3/26/2021

MARKET RECAP

US stocks were up by about 1.5% for the week.

As if the $1.9 trillion stimulus, coming on top a few trillion prior was not enough, Biden is putting the finishing touches on his next proposal, a $3 trillion infrastructure package. So the spending of the monopoly money looks like it is set to continue without a care. Don’t worry, Biden figures he will pay for all of this with higher taxes.

Consumer spending was down 1% in February, mainly due to the cold weather, according to economists. Household income, without the benefit of Federal giveaways, was down by 7.1%. But economic activity is expected to jump higher over the next few weeks and months. Visits to restaurants and hotels are up, and airline activity continues to increase. Inflation remained under control in February. The price index for personal consumption expenditures was up by 1.6% year over year. That was up from 1.4% in January and was the largest increase since February of 2020, but still shy of the 2.0% target. The Fed expects inflation to reach 2.4% by the end of 2021 and then drop back to the 2% target.

SCOREBOARD

Week Ending 3/19/2021

MARKET RECAP

Stocks were off by 1.03% in the US and were higher outside the US by 0.17%. Bonds fell by 0.25% as the 10-year yield continued to rise. Oil dropped by 6.4%. Investors are worried about threats of inflation and interest rates that are rising quicker than anticipated.

The yield on the 10-year Treasury is up by 89% year-to-date, and the market started noticing the increase around February 8th, since then stocks have been flat.

Taxpayers received $242 billion in stimulus payments on Wednesday, a good portion will end up in the equity markets. Bank of America reports that $68.3 billion was invested in equity funds this past week.

Former Treasury Secretary and Democrat Lawrence Summers is not happy about the stimulus, saying “these are the least responsible fiscal macroeconomic policy we’ve had in the last 40 years,” and putting the blame on both parties. Summers says we a facing a “pretty dramatic fiscal-monetary collision.” He says there is a 1 in 3 chance the US will face stagflation, or the Fed will push the brakes too hard forcing a recession.

SCOREBOARD

Week Ending 3/12/2021

HIGHLIGHTS

- The US was up by 3.31% and international 1.85%. The Dow and the S&P 500 close at record highs.

- The 10-year increases by 8 basis points and the 30-year by 12.

- The $1.9 trillion stimulus package is now law.

- Every adult in the US will be eligible for a vaccine by May 1 according to Biden.

- Henry Kaufman worries about the market’s reliance on the Fed…

- …and their independence

- Household wealth at an all-time high.

- GME soars again.

MARKET RECAP

US stocks advanced by 3.31% and international stocks were up by 1.85%. Bonds declined by 0.43% as the long end of the curve continued to see higher interest rates. The S&P 500 and the Dow closed at a record high. The Nasdaq 100, which was off its high by about 10% last week, rallied and is now down 6.3%. A massive stimulus bill and Biden’s announcement that every adult in the US can get a vaccine by May 1 fueled the optimism.

The $1.9 trillion stimulus package was passed into law. The economy was already set for strong growth in 2021, but the economy might really accelerate now with this. This is the likes of which we have never seen before, a massive stimulus package, coming on the heels of two other massive stimulus packages, plus interest rates at close to zero, and a Fed promising to let inflation run hotter than its target with no intervention.

Higher interest rates on longer-term bonds like the 10-year could force expanded P/E ratios to contract, but the bulls are counting on booming earnings to offset the lower ratio to keep stocks on the march higher.

Randall Forsyth writes in Barron’s this week about Henry Kaufman, the widely followed chief economist at Salomon Brothers in the 1970s and 80s, who has written a new book, to be released next month, The Day the Markets Roared. A reference to his call that long-term interest rates would decline back in August of 1982. That set off the rally of the 80s, 90s, and arguably beyond. Kaufman now questions the independence of the Fed. “The implication is near-term political decisions may have greater force over financial market behavior than ever before.” Going on to say that “It seems to be that the equity markets are highly dependent on the continuation of monetary ease.” Basically, we are at the exact opposite point from August of 1982. Back then, we had sky-high interest rates with a tight Fed run by Paul Volker that operated with a long-term view, whereas now, we have artificially low-interest rates, almost at zero, with a Fed willing to monetize most anything and seemingly in sync with the desires of the administration.

Household wealth soared last year by 10% to an all-time high of 130.2 trillion. Of the 5.6% increase in the 4th quarter, almost all of it came from asset price gains.

Gamestop (GME) closed this week at $264.50 and got as high as $348.50. It has declined to about $40 in February after its first incredible run. The recent rally began when Ryan Cohen, the Board member and founder of Chewy, was selected to lead a board committee to work on the Company’s transformation into the digital age. GME is symbolic of this crazy market and some of the rampant speculation that is marking this era.

SCOREBOARD

Week Ending 3/5/2021

Some highlights from the week:

- 370,000 new jobs added in February, a strong report.

- GDPNow is projecting Q1 growth of 8.3%.

- The yield on the 10-year continues to rise, closing at 1.551%, down from 1.626%.

- Inflation expectations are rising, now at 2.22% based on the 10-year breakeven.

- Nasdaq is down 8.3% in three weeks and was down more than 10% on Friday morning.

SCOREBOARD

Week Ending 2/26/2021

MARKET RECAP

Stocks were down by 2.86% in the US and 3.92% outside the US. Bonds fell by 0.43%. Spiking interest rates and the fear of inflation dropped stocks.

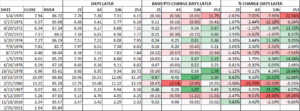

The yield on the 10-year Treasury rose by 16 basis points on Thursday to close at 1.54%. That is up by 50 basis points since January 27, about one month ago, and up from the August 2 closing low of 0.52 by 102 basis points.

What has been most dramatic is the speed of the increase. A technical indicator called the Relative Strength Index (RSI), developed by J. Welles Wilder in the 1970s does a good job measuring the speed and change of price movements. According to Wilder, an RSI reading above 70 indicates an overbought condition. Yesterday, the RSI, as measured over 14-days, for the 10-year was 85.89. An RSI reading above 85 is rare.

It has only happened three times this century, back in 2007 and 2016. It did not happen at all in the 1990s and only happened two times in the 1980s. When it did happen frequently was the 1970s when it occurred 11 times*. The 1970s was a decade of high inflation and interest rates.

The exploding interest rate makes some sense. As we have been writing about when you are spending trillions like it is nothing, something is bound to happen, whether that be inflation or higher interest rates, or both. It is too early to say if this kind of increase is a foreboding of things to come, or just a one-off. We do not want to relive the 1970s, at least in economic terms.

Interest rates have been artificially suppressed. And that has led to artificially high asset prices, in the stock market and also. It has also distorted the economy by giving a lifeline to “zombie” companies. It has suppressed the creative destruction process. So a return to a normal interest rate would be good, but not in a runaway manner. That would be too disruptive and cause a host of other problems.

Jobless claims fell to the lowest level since November, dropping by 111,000 to a seasonally adjusted 730,000 last week. Weekly claims rose as high at 900,000 in early January but have been dropping since as the job market appears to be picking up some slow momentum.

Consumer spending was up by 2.4% in January as household incomes increased by 10%, helped by stimulus checks.

SCOREBOARD

RSI on 10-Yr Breaks 85 for 3rd Time Since 1987

RSI Breaks 85 on the 10-Year Yield

The yield on the 10-year Treasury rose by a staggering 16 basis points yesterday to close at 1.54%. That is up by 50 basis points since January 27, about one month ago, and up from the August 2 closing low of 0.52 by 102 basis points.

What has been most dramatic is the speed of the increase. A technical indicator called the Relative Strength Index (RSI), developed by J. Welles Wilder in the 1970s does a good job measuring the speed and change of price movements. According to Wilder, an RSI reading above 70 indicates an overbought condition. Yesterday, the RSI, as measured over 14-days, for the 10-year was 85.89. An RSI reading above 85 is rare.

It has only happened three times this century, back in 2007 and 2016. It did not happen at all in the 1990s and only happened two times in the 1980s. When it did happen frequently was the 1970s when it occurred 11 times*. The 1970s was a decade of high inflation and interest rates.

The exploding interest rate makes some sense. As we have been writing about when you are spending trillions like it is nothing, something is bound to happen, whether that be inflation or higher interest rates, or both. It is too early to say if this kind of increase is a foreboding of things to come, but let’s hope not. We do not want to relive the 1970s, at least in economic terms.

*Please note we are only counting the initial reading, so if it happened on day 1, and also on day 2 and day 3 or even a few days later, like day 5, that would count as just one reading.

Week Ending 2/19/2021

MARKET RECAP

Stocks were down by 0.73% in the US and 0.26% outside the US. Bonds fell by 0.63%. The yield on the 10-year treasury is now at its highest level since the pandemic began, closing at 1.34%. Bitcoin burst through $50,000 and is currently trading at about $56,000.

Helped by stimulus checks, retail sales advanced by the most in seven months in January, up by a seasonally adjusted 5.3%. The increase topped all estimates and indicates strong consumer demand. The Atlanta Fed’s GDPNow model now projects a 9.5% annualized growth rate in Q1, up from 4.5%. Industrial production was also up, for the fourth consecutive month, increasing by 0.9%.

While retail sales were surging, so were producer prices, which jumped by 1.3%. That was the biggest increase in the records that date back to 2009. The rising producer prices (PPI) haven’t spilled over into the CPI yet, but it is probably only a matter of time. Now it is only one month and maybe it is an aberration, but when the government throws trillions into the economy and then wants to add a couple of trillion more, the threat of inflation has to be considered. Higher inflation would mean higher interest rates, which would make it difficult for the government to do anything other than pay off interest in the future, it would also cut into p/e ratios which could cause the market to decline. Maybe none of this happens but for those of us that lived through the 70s, it is a threat not to be taken lightly.

SCOREBOARD

Week Ending 2/5/2021

MARKET RECAP

Stocks had a big week as US equities advanced by 5.25% and international markets were up by 4.95%. US stocks ended the week at a record high. It was the best week since November as investors were looking forward to a $1.9 trillion stimulus package. For the same reason stocks were up, bonds were down, falling by 0.35% as the prospects of inflation lifted interest rates on the longer end of the curve. Oil jumped by almost 9%.

Dropping virus numbers are also helping. How much the vaccination program has helped no one is sure, but the huge second tidal wave of Covid seems to be slowing, similar to what happened to other waves in previous pandemics. The Super Bowl this weekend will be a test to see if social gathering around the country ignites a rebound, but for right now, recent numbers are very encouraging.

The Democrats are moving ahead without the Republicans on a stimulus plan valued at close to $2 trillion dollars. This is after a $900 billion plan passed in December and the trillions spent earlier in the year. There is simply no concern for the out of control deficits and the debt burden we are laying on future generations. We are putting the country in a dangerous situation at some future point when interest rates rise, but nobody cares. Biden should settle for a more reasonable plan that focuses on getting the country vaccinated, helping those who are truly in need, and for targeted infrastructure investments that will have a clear positive payoff. Even former Obama economic advisors Larry Summers and Jason Furman thinks the package is too big. Summers said, “stimulus measures of the magnitude contemplated are steps into the unknown.”

The economy just does not need a massive plan like this. Most of the spending will start to hit just when most of the country will have been vaccinated and a year-plus of pent up demand will start to be unleashed. All of this deficit spending, on top of more regulations, monetary expansion, and reduced international trade is a recipe for inflation, which potentially means much higher interest rates. And much higher interest rates on top of an out of control deficit will crowd out spending on needed programs in the future and threaten the value of the dollar. The government cannot act like the US dollar is monopoly money, because if they continue to do so, that is how it will end up.

Gamestop (GME) came back to earth this week. GME closed at $63.77, down 80% on the week and down by 87% from its high last week. It is still way above where it was a couple of weeks back, but while many were smart enough to cash out, there were probably more who bought at higher prices expecting GME to go even higher and are now left with huge losses, or those that rode the stock all the way up and all the way down. Moreover, the Wall Street Bets Reddit page, where many of these “investors” got their inspiration, was encouraging/telling their followers to hold GME stock straight through and not to sell no matter what. Of course, as the losses piled on, the prevailing Reddit theme was that the system was rigged, failing to take personal responsibility for buying GME at simply ridiculous prices and without regard to any fundamentals. The GME saga is just a sign of the times.

As is Dogecoin, a cryptocurrency that is flying high and is now worth more than $6 billion. Dogecoin was created as a joke in 2013. Like it was literally created as a joke, the developer wanted to create a coin that couldn’t be taken seriously. The developer, Billy Markus, spent a grand total of three hours one Sunday afternoon creating the currency. But Elon Musk has tweeted about it a couple of times in recent weeks and it has increased in value by 80%. In addition, the Reddit crowd is aiming to push the coin to $1 from its current 8 cent value. People are buying something with an intrinsic value of $0 but that doesn’t matter. It is the same mindset that pushed GME to $500 per share, but even worse, at least GME has a business with some kind of prospects (if it can be turned around) of generating cash flow.

Payrolls increased by 49,000 in January, and the December job loss was revised up to 227,000 from 140,000. Lower labor force participation dropped the unemployment rate to 6.3% from 6.7%. All in all, the payrolls report was considered a disappointment.

Normally, home prices fall in a recession, but not this time. Prices are up sharply, rising by 9.1% year over year in November. Home prices have benefited from Covid, as city residents move to homes in the suburbs, but also by the Fed’s monetary policy, which has included buying $40 billion per month in mortgage securities. That has reduced mortgage rates which have increased demand and thus, more expensive homes. The problem is first-time home buyers and others are being priced out of the market. The other problem, which we allude to above, is that excessive monetary and fiscal stimulus is starting to lead to inflation which could be a big problem down the road.

SCOREBOARD