MARKET RECAP

Stocks were off by 1.03% in the US and were higher outside the US by 0.17%. Bonds fell by 0.25% as the 10-year yield continued to rise. Oil dropped by 6.4%. Investors are worried about threats of inflation and interest rates that are rising quicker than anticipated.

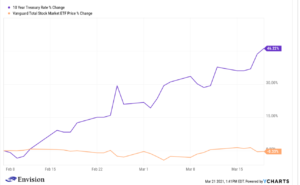

The yield on the 10-year Treasury is up by 89% year-to-date, and the market started noticing the increase around February 8th, since then stocks have been flat.

Taxpayers received $242 billion in stimulus payments on Wednesday, a good portion will end up in the equity markets. Bank of America reports that $68.3 billion was invested in equity funds this past week.

Former Treasury Secretary and Democrat Lawrence Summers is not happy about the stimulus, saying “these are the least responsible fiscal macroeconomic policy we’ve had in the last 40 years,” and putting the blame on both parties. Summers says we a facing a “pretty dramatic fiscal-monetary collision.” He says there is a 1 in 3 chance the US will face stagflation, or the Fed will push the brakes too hard forcing a recession.

SCOREBOARD