MARKET RECAP

Stocks finished the week just off the Thursday record high, up by 1.57% for the week. From September 2nd to October 4th, the overall US market fell by 5.1%. Since then, stocks have rallied and are now about 0.3% above the September 2nd close.

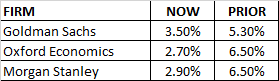

Stocks have managed to rally despite rising interest rates. The 10-year Treasury has increased from 1.19% on August 3rd to 1.66% as of Friday. Projected inflation is measured at 2.66%, the highest rate in 15 years. Over the last few weeks there seems to have been a shift from the mantra that inflation is “transitory” to something that will be a bit longer, maybe a lot longer, than that. The Fed has indicated that tapering will start in November. Oil prices are at the highest level since 2014. Estimates for economic growth are falling. The Atlanta Fed’s GDP model now projects Q3 growth at only 0.5%. In China, the Evergrande Group, the real estate behemoth, is on the edge of bankruptcy, with a likely negative impact on the Chinese real estate sector, which represents 30% of China’s output. None of this seems to matter to the market, which is back at new highs.

Exxon is supposedly considering dropping several oil and gas projects, as directors are worried about carbon emissions. This at a time when energy prices are surging and capex across the industry is falling. Exxon’s board took a turn when a hedge fund with a 0.02% interest, Engine No. 1, managed to get their nominees added to the Company’s Board.

SCOREBOARD