MARKET RECAP

US stocks were down by 1.83% and international equities were off by 0.80% for the week. Stocks closed at the low on Friday and are resting right on the support level from mid-August.

Damage from the Delta variant is starting to show up in the economy. Offices are delaying opening, businesses are pulling back on travel, and spend-happy consumers are slowing down. Hiring in August came in way less than expectations, and the University of Michigan consumer sentiment poll taken in late August fell to the lowest level in a decade.

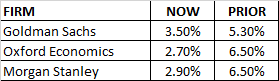

The Atlanta Fed’s GDPNow model is currently estimating 3.7% growth down from 5.3% at the start of the month. Over the last week, economists across the board have cut their growth forecasts.

Delta gets most of the blame, but the ending of government aid also plays a part. A recent Census Bureau survey shows that 41% of households said they used some form of government assistance to help with everyday expenses.

At the same time that economists were cutting estimates, some analysts are becoming cautious on US equities. Bank of America is projecting 4260, that is 4.7% below the Friday close, and 4600 at the end of next year, up 3% for next year. Morgan Stanley moved US stocks to “underweight” with a preference for Japan and Europe, and an overweight in cash. “Morgan Stanley strategists forecast cash to outperform U.S. equities, government bonds and credit over the next 12 month”, said a note from the firm.

SCOREBOARD