MARKET RECAP

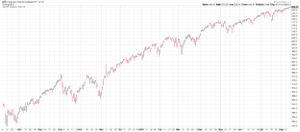

US stocks were up by 0.56% and international stocks increased by 0.81%. The US market closed at another high while international stocks are still off of their June highs.

Producer prices increased by 7.8% year over year in July, indicating that the “transitory” inflation is so far a bit more than the Fed ever expected. Meanwhile, the Senate is working on a $3.5 trillion package, at the same time they are getting closer to passing a $1 trillion infrastructure package, on top of all the trillions thrown in to the economy last year, and they wonder why prices are up?

Barry Knapp, director or research at Ironsides Macroeconomics, said in Barrons this weekend, “We have this setup now that is very similar to the 1960s, which led to the Great Inflation of the 1970s.”

There were more jobs available in the US in June than at anytime. Unfilled job openings increased by 590,000 in June to 10.1 million unfilled jobs. That exceeds the number of unemployed by more than 500,000.

An article in Bloomberg on Saturday says analysts are the most optimistic in two decades. About 56% of recommendations are buys, that is the most since 2002. This coming when markets are at all-time highs and valuation metrics are stretched.

SCOREBOARD