SCOREBOARD

Category Archives: Uncategorized

Week Ending 7/29/2022

MARKET RECAP

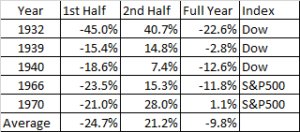

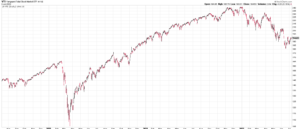

The S&P 500 fell by 20.6% for the first six months of the year. At the time, we wrote, “the market has fallen at least 15% in the first six months of the year in 1932, 1939, 1940, 1962, and 1970, down by an average of 24.7% in those years. But stocks rallied in the back half of those years by an average of +21.2%.” At least so far, true to form, stocks went into rally mode, the S&P 500 gained 9.1% for July, the best performance since November of 2020. The monthly performance was helped by an ultra-strong week, US stocks were up by 4.2% and international stocks by 3.2%. Bonds increased by 0.69% as interest rates continued to fall.

Investors are counting on the old bad news is good news mindset. A slowing, or declining economy, means interest rates don’t need to rise as much, and interest rates cuts would happen sooner than expected. Also earnings have not been as bad as feared.

But it is still too early to call the all clear. There have been plenty of times when markets have gone back to test the lows, or even break them. Inflation is not done yet, the economy just banked two successive quarters of declining growth, with no clear signs of an economic pickup. Cutting interest rates too soon would be out of the 1970s playbook, a strategy that didn’t work so well in fighting inflation.

GDP declined by 0.9% in the second quarter. That marks the second straight quarter of declining GDP, the unofficial sign of a recession. Wages and benefits increased by 5.1% in the second quarter, compared to a year earlier, but that was short of the 9.1% increase in consumer prices. The wage and benefit increase was the most ever, since they started keeping records in 2001.

SCOREBOARD

Week Ending 7/22/2022

MARKET RECAP

US stocks increased by 2.8% for the week, putting in its best performance in a month. The international markets were up by 3.1%, and bonds jumped by 1.09% as interest rates fell sharply. But stocks did not close the week well, on Friday, the S&P 500 fell by 0.9% on disappointing earnings by Snap, which dropped by 39%. Meta and Alphabet fell in sympathy, registering drops of 7.6% and 5.6%.

S&P 500 companies have beaten estimates by 3.6% according to FactSet, lower than the five-year average of 8.8%. About 20% of companies have reported. But there is a chance that earnings growth will actually be lower when all is said and done, after backing out energy profits.

The Markit Composite Purchasing Managers Index fell into contractionary mode, registering a 47.5 score. Also, the Conference Board’s leading indicators turned negative. The composite PMI for Europe fell to 49.4 from 52.

Jobless claims continued their slow, but steady rise, with a 7,000 increase from last week to 251,000. The four-week average was up by 4,500 to 240,500. Continuing claims totaled 1.4 million and was up from 1.3 million the week prior. Guy Berger, the principal economist at LinkedIn said “It doesn’t look recessionary…but it’s definitely less good than it was before.”

The ECB raised rates by 50 basis points, bringing their key interest rate out of negative territory to zero. They also unveiled a plan to buy debt from the weaker countries.

SCOREBOARD

Week Ending 7/15/2022

MARKET RECAP

- US stocks were off by 0.91% while international equities fell by 2.31%. Bonds increased by 1.01%. The yield on the 10-year dropped by 16 basis points but the 3-month yield increased by a whopping 30 basis points. The 2-year treasury bond (3.13%) is inverted when compared to the 10-year (2.93%), a possible recession indicator.

- Earnings season started this week and companies representing 6% of the S&P 500 market cap reported, excluding financials, earnings beat estimates by 3.3%. Financials did not fare as well, JP Morgan and Wells Fargo missed estimates. JPM froze its buyback program and increased its capital cushion for potential future credit losses. WFC and Citibank did the same, setting aside hundreds of millions for possible future credit losses. Citibank Chief Executive Jane Fraser said, “While sentiment has shifted, little of the data I see tells me the U.S. is on the cusp of a recession…so while a recession could indeed take place over the next two years in the U.S., it’s highly unlikely to be as sharp a downturn as others in recent memory.”

- Inflation clocked in at 9.1%, the highest number in the last 40 years, and worse than expected. Grocery prices were 12.2% higher. Inflation is a backward looking indicator, but it was hard to find anything good in the report. The only good news, not reflected in this report, is that commodity prices have been falling hard in the last few weeks. Gas is now $4.577 per gallon compared to a June 14th peak of $5.016, according to the AAA.

- Retail sales were up by 1% in June, but that trailed the 1.3% increase in consumer prices. The sales numbers showed that for the most part, consumers are hanging in there with higher prices.

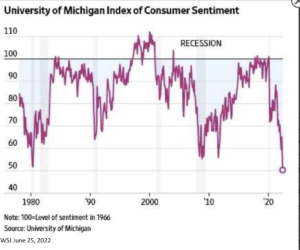

- The Fed said that manufacturing output fell for the second straight month in June. Home construction is slowing. And the University of Michigan index of consumer sentiment was close to the lowest level on record.

- Initial jobless claims were 244,000, up from 235,000. The number is still low historically has been been very slowly trending higher.

SCOREBOARD

Week Ending 7/8/2022

MARKET RECAP

- Stocks rallied on the week with the S&P 500 advancing by 1.95% for the week. Many of the high-flyers which have been battered this year, staged a comeback, with the ARK Innovation ETF (ARKK) rising by almost 14%, while this year’s winners, the energy stocks, continued their recent fall. The Energy Select SPDR (XLE) declined by 2.25% for the week and is down by 23% since its June 8th closing high.

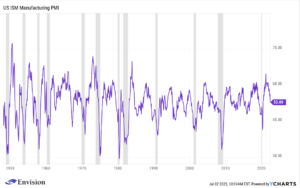

- The ISM non-manufacturing PMI fell to 55.3 in June from 55.9 in May, a smaller fall then expected, indicating the economy may not be falling as fast as some fear. The consensus was for a drop to 54.3.

- It was another strong jobs report, as employers added 372,000 jobs in June, much better than the 250,000 estimate, although slightly lower than the 400k average for the previous three months. The report ran counter the popular narrative that the economy is falling fast. The unemployment rate stayed the same at 3.6%. Average hourly earnings increased by 5.1% compared to the prior year. The labor force participation rate dropped to 62.2% from 62.3% in the prior month.

- The 2-10 yield curve remained inverted this week, even as the 10-year yield increased to 3.1%, up by 11 basis points.

- Auto loans are beginning to default Subprime repossessions have almost doubed since 2020.

- The euro is down 10% this year and hit a 20-year low versus the US dollar.

- Gas prices have fallen for 24 straight days and is now priced at $.72 per gallon, according to OPIS, as opposed the its peak of $5.02 per gallon on June 14. Down by 6%. Strong demand for the rest of July will put add to pressure for higher prices.

- Elon Musk called off his deal for Twitter, citing fake user accounts, an issue he knew about before-and. Twitter will sue Musk seeking to enforce the deal. The stock market isn’t buying it, it never has, Twitter has been selling at about $37/share compared to the buyout price of $54.20.

SCOREBOARD

Week Ending 7/1/2022

MARKET RECAP

Stocks posted their worst 6-month start to the year since 1970 as the S&P 500 fell by 20.6%, the Dow was down by 15.3% and the Nasdaq Composite fell by 29.5%. There was no safe haven in bonds, the aggregate dropped 10.7%. Oil was up by 40%. For the week, US stocks fell by 2.35% and international stocks by 1.66%. The bond market rallied on lower interest rates, up by 1.46%. Earnings estimates are starting to fall but the changes have been small so far, that is likely to change going forward.

The market has fallen at least 15% in the first six months of the year in 1932, 1939, 1940, 1962, and 1970, down by an average of 24.7% in those years. But stocks rallied in the back half of those years by an average of +21.2%.

The average gallon of gas was $4.84 on Friday, compared to $3.12 last year, but down from the June 14th peak of $5.02, according to OPIS, an energy-data and analytics provider. Despite high gas prices, travelers are hitting the road in record numbers this July 4th, according to the AAA. That is in line with the June momentum, with record rentals for Airbnb and strong hotel results.

But manufacturing demand is beginning to slow down, in response to high prices. Activity at US factories grew at the slowest pace in two years, according to the Institute for Supply Management’s purchasing managers index. The index was measured at 53, down from 54.9 in June. A number above 50 is considered expansionary, below contractionary. New orders were measured at 49.2 and declined for the first time in two years. The Employment index was 47.3 and fell for the second month in a row. In a bit of good news, the measure of prices paid fell to 78.5 from 82.2 in June.

Auto sales were generally down around 15%, GM said nearly 100,000 vehicles in Q2 could not be delivered because they lacked computer chips.

The Atlanta Fed’s GDPNow is estimating Q2 growth at negative 2.1%.

Amidst the global shortage of oil, the Biden administration announced that it would allow up to 11 oil leases offshore, in the Gulf of Mexico and Alaska, while blocking leases in the Atlantic and the Pacific. Predictably, the proposed plan drew immediate condemnation from environmental groups for allowing any drilling at all and from oil advocates, that it didn’t go far enough.

SCOREBOARD

Week Ending 6/24/2022

MARKET RECAP

The S&P 500 index had a big week as it rallied by 6.4%, the Dow gained 5.4% and the Nasdaq was up by 7.5%. On Friday, the S&P has its biggest rally in more than two years, up by 3.1%. A lot of the rally was powered by falling commodity prices and signs of a slowing economy, which investors took to mean lower inflation and less of a need to raise interest rates as high as might have been feared. As an example, cooper fell 65 on the week and is close to a one-year low, down 16% over the last three weeks.

The University of Michigan’s consumer sentiment survey fell to 50, the lowest readying ever, and this survey dates back to 1952. 79% of consumers were pessimistic about future business conditions, the highest since 2009, and 47% said that inflation was “eroding their living standards.” Consumer expectations of long-run inflation fell from 3.3% to 3.1% over the next five years, that is back within the 2.9% to 3.1% range that has been measured for most of the last 10-months. For the next year, consumers expect inflation of 5.4%.

New-home sales were up by 10.7% in May while sales of previously owned homes was down by 3.4%. The rate on a 30-year mortgage is now at 5.81%, the highest level since 2008. Ian Shepherdson, chief economist of Pantheon Macroeconomics wrote that “The housing market is rolling over, and sales will fall sharply over the next few months.”

The US composite purchasing managers index fell to a five-month low of 51.2 in June from 53.6 in May.

Week Ending 6/17/2022

MARKET RECAP

- The bear market is now in full swing, with most expecting more downside to come. The S&P 500 dropped by 5.8% this week, the biggest decline since the pandemic hit. The S&P has dropped 10 of the last 11 weeks. Wilshire Associates estimates the market cap of US equities is down by 12.5 trillion this year. The crypto market was even worse, bitcoin fell by 30% and there are signs that some crypto lending platforms are freezing up. Celsius Networks put a pause on all withdrawals.

- The Fed raised rates by 0.75% and said they expect the economy to slow significantly. It was the biggest increase since 1994. The Fed is now expected to raise rates by another 1.75 percentage points over the remainder of this year, to about 3.75%.

- Much higher interest rates increase the chances of a deeper recession significantly. P/E ratios will decline as the interest rates increase, and to make matters worse, the “E” in the P/E will fall due to the recession. And all of this is further complicated by the war in Ukraine, which has reduced energy and food supplies, and by broken supply chains, which have been damaged further by tight Covid restrictions in China. Almost every analyst out there predicts more downside to come. At least over the next year or so.

- Models at Bloomberg Economics place the chance of a recession by 2024 at 72%.

- Meanwhile, commodity prices fell this week. Oil was down by 8.98% this week and energy companies fell hard. The XLP was down by 17.16% for the week and is 20% off its high. Cooper was off by 6.6% for the week. Residential investment is down by about 20% for the quarter.

- $2 trillion of cyptocurrency value has been erased since November. Bitcoin is off 70% from its high.

- According to Mark Hulpert, if “you bought stocks on the day the S&P 500 closes below the 20% loss threshold.. on average you would have done very well…and you wouldn’t have had to wait that long to do so. Over the 12 months following your buys, your average total return would have been 22.7%. Click for the article.

- Retail spending fell in May by a seasonally adjusted 0.3% compared to April. It was the first decline in over a year. Housing and auto sales were both down. The savings rate was at its lowest level in 14 years, indicating that consumers are dipping into savings to offset inflation.

SCOREBOARD

Week Ending 6/10/2022

MARKET RECAP

Stocks got hit on Thursday and then again on Friday, falling 2.4% on Thursday and almost 3% on Friday. Declines were only minor on Thursday until the sell-off in the final hour which was steep in anticipation of the Friday inflation report. The inflation report turned out to be worse than expected, the CPI was up by 8.6% compared to the prior May and was the biggest increase since December of 1981. Energy was up by 34.6% and groceries by 11.9%. The report was so bad that analysts began calling for a 1% increase in interest rates at the Fed’s next meeting as opposed to the half-point that the Fed has already signaled. For the week, US stocks were down by 5.06%, international by 4.11%, and bonds by 1.53%.

The ECB said it would increase interest rates from minus 0.5% to zero or higher by September with more increases after that.

Multinational companies have taken losses of about $59 billion from either closing up shop in Russia, cutting back, or just being impacted by their diving economy.

The University of Michigan consumer sentiment gauge fell to a record low of 50.2.

The 2-year treasury is now yielding greater than 3% (3.047%).

Home price increases are starting to slow. Active home listings have increase year over year for five weeks in a row according to Realtor.com and the growth of median listing price has slowed. New home sales are down 16.6%.

SCOREBOARD

Week Ending 6/3/2022

MARKET RECAP

- US stocks fell by 1.07% for the week. Interest rates were up, the yield on the 10-year treasury increased by 22 basis points to 2.96%.

- Payrolls were up by 390,000 in May, down from 436,000 in April, and the slowest pace of growth since April of 2021. The unemployment rate was flat at 3.6%. Wages were up by 5.2% compared to last year, down from 5.5% in April. Two million people from age 25 to 54 have joined the labor force since September. The labor force participation rate is now 62.3% up from 62.2% in April but still lower than the pre-pandemic February 2020 number of 63.4%.

- Jamie Dimon of JP Morgan said, in reference to the economy, “That hurricane is right out there down the road coming our way, we just don’t know if it’s a minor one or superstorm Sandy. You have to brace yourself.” Bank of America CEO Brian Moynihan has a more sanguine outlook and said that customers are not talking about recession. Elon Musk said he has a “super bad feeling” about the economy.

- Tesla announced it would cut 10% of salaried jobs.

- Existing-home sales fell by 5.9% in April from the previous year.

MARKET RECAP