MARKET RECAP

Stocks posted their worst 6-month start to the year since 1970 as the S&P 500 fell by 20.6%, the Dow was down by 15.3% and the Nasdaq Composite fell by 29.5%. There was no safe haven in bonds, the aggregate dropped 10.7%. Oil was up by 40%. For the week, US stocks fell by 2.35% and international stocks by 1.66%. The bond market rallied on lower interest rates, up by 1.46%. Earnings estimates are starting to fall but the changes have been small so far, that is likely to change going forward.

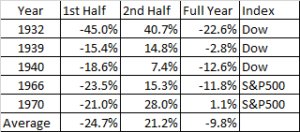

The market has fallen at least 15% in the first six months of the year in 1932, 1939, 1940, 1962, and 1970, down by an average of 24.7% in those years. But stocks rallied in the back half of those years by an average of +21.2%.

The average gallon of gas was $4.84 on Friday, compared to $3.12 last year, but down from the June 14th peak of $5.02, according to OPIS, an energy-data and analytics provider. Despite high gas prices, travelers are hitting the road in record numbers this July 4th, according to the AAA. That is in line with the June momentum, with record rentals for Airbnb and strong hotel results.

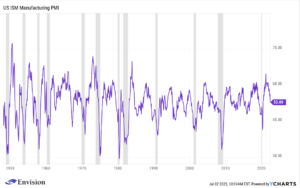

But manufacturing demand is beginning to slow down, in response to high prices. Activity at US factories grew at the slowest pace in two years, according to the Institute for Supply Management’s purchasing managers index. The index was measured at 53, down from 54.9 in June. A number above 50 is considered expansionary, below contractionary. New orders were measured at 49.2 and declined for the first time in two years. The Employment index was 47.3 and fell for the second month in a row. In a bit of good news, the measure of prices paid fell to 78.5 from 82.2 in June.

Auto sales were generally down around 15%, GM said nearly 100,000 vehicles in Q2 could not be delivered because they lacked computer chips.

The Atlanta Fed’s GDPNow is estimating Q2 growth at negative 2.1%.

Amidst the global shortage of oil, the Biden administration announced that it would allow up to 11 oil leases offshore, in the Gulf of Mexico and Alaska, while blocking leases in the Atlantic and the Pacific. Predictably, the proposed plan drew immediate condemnation from environmental groups for allowing any drilling at all and from oil advocates, that it didn’t go far enough.

SCOREBOARD