MARKET RECAP

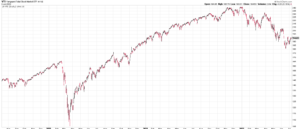

- Stocks rallied on the week with the S&P 500 advancing by 1.95% for the week. Many of the high-flyers which have been battered this year, staged a comeback, with the ARK Innovation ETF (ARKK) rising by almost 14%, while this year’s winners, the energy stocks, continued their recent fall. The Energy Select SPDR (XLE) declined by 2.25% for the week and is down by 23% since its June 8th closing high.

- The ISM non-manufacturing PMI fell to 55.3 in June from 55.9 in May, a smaller fall then expected, indicating the economy may not be falling as fast as some fear. The consensus was for a drop to 54.3.

- It was another strong jobs report, as employers added 372,000 jobs in June, much better than the 250,000 estimate, although slightly lower than the 400k average for the previous three months. The report ran counter the popular narrative that the economy is falling fast. The unemployment rate stayed the same at 3.6%. Average hourly earnings increased by 5.1% compared to the prior year. The labor force participation rate dropped to 62.2% from 62.3% in the prior month.

- The 2-10 yield curve remained inverted this week, even as the 10-year yield increased to 3.1%, up by 11 basis points.

- Auto loans are beginning to default Subprime repossessions have almost doubed since 2020.

- The euro is down 10% this year and hit a 20-year low versus the US dollar.

- Gas prices have fallen for 24 straight days and is now priced at $.72 per gallon, according to OPIS, as opposed the its peak of $5.02 per gallon on June 14. Down by 6%. Strong demand for the rest of July will put add to pressure for higher prices.

- Elon Musk called off his deal for Twitter, citing fake user accounts, an issue he knew about before-and. Twitter will sue Musk seeking to enforce the deal. The stock market isn’t buying it, it never has, Twitter has been selling at about $37/share compared to the buyout price of $54.20.

SCOREBOARD