Scoreboard

Category Archives: Uncategorized

Week Ending 2/17/2023

Week Ending 2/10/2023

Week Ending 2/3/2023

MARKET RECAP

US stocks rallied by 1.94%, while international stocks fell by 1.04%. Bonds were flat.

The US added 517,000 jobs in January, way above estimates of less than 200,000, and in the process, dropped the unemployment rate to 3.4%, a 53-year low. Over the past year, wages were up by 4.4%, down from a revised 4.8% in December. The extra strong jobs report does not jive with other economic reports that show that consumer spending started to slow at the end of the year and that manufacturing activity declined. But new orders did increase, according to the Institute of Supply Management Business Activity Index, which increased to 60.4% from 45.2% in December. The Service Sector was also up, at 55.2 versus 49.2 in December.

The Fed raised its bench market interest rate to 4.75% from 4.5%. The strong jobs report led some investors to suspect that the Fed will continue for the time being on increasing rates and hold off cutting interest rates longer than expected.

SCOREBOARD

Week Ending 1/27/2023

MARKET RECAP

- The S&P 500 rallied by 2.5% this week and US stocks broke the declining trend line and also broke above the 200-day moving average, a positive sign that maybe, and we emphasize “maybe”, the market is entering a new positive phase. The NASDAQ is up by 11% so far in 2023.

- The M2 money supply, which measures the amount of money in the economy, declined by 1.3% year over year in December. The first decline ever, since the Fed started publishing the statistic in 1959. However, compared to pre-pandemic, M2 is 37% greater.

- Consumer spending declined by 0.2%.

- The Personal Consumption Expenditures Index (PCE) increased by only 4.4% year over year, another sign that inflation is abating.

- There were only 186,000 new jobless claims, a low number. But the number of temporary jobs has fallen for five straight months. Falling temporary jobs has often been a precursor to a recession.

SCOREBOARD

Week Ending 1/20/2023

MARKET RECAP

- The S&P dropped by 0.7% but the Dow took a bigger hit, -2.7%.

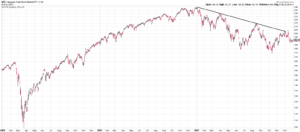

- US stocks could not break through the declining trendline, meaning the trend is still negative.

- The debt ceiling is a short and intermediate-term threat to the economy and the market.

- Jobless claims fell to 190,000 last week, the lowest level since September, indicating that the job market remains tight. However, there were several announcements of layoffs in the tech sector, Google will layoff 12,000 workers, Microsoft 10,000, and Amazon 18,000.

- Existing home sales wrapped up their worst year since 2014 in December. Sales were off by 17.8% compared to 2021. For the month of December, sales dropped by 1.5%, making it 11 months in a row of monthly sales declines.

SCOREBOARD

Week Ending 01/13/2023

MARKET RECAP

US stocks advanced by 3.09%, international stocks by 3.37%, and bonds were up by 0.84%. International stocks continue to outperform and appear on an uptrend now, while US stocks are close to breaking the declining trend line (see the two charts below).

2022 trends are reversing, helping investors; lower interest rates, a lower dollar, tech stocks, and crypto is rallying, and inflation is falling.

With a Republican-controlled house, and the recent shenanigans in electing a speaker, don’t count on a smooth increase in the debt ceiling. We have already seen congressmen (and women) operate in their own perceived best interests, even when the well-being of the country is at stake. The Treasury should be good until early June.

SCOREBOARD

Week Ending 1/6/2023

MARKET RECAP

- S&P 500 +1.45%

- Wage inflation dropped to 4.6% year over year, down from 5.1%. Long-term yields fell, and stocks went up on the news.

- The unemployment rate fell to 3.5%.

- ISM services fell into contractionary territory for the first time since May 2020.

- Earnings estimates for 2023 from bottom-up strategists are for a 4.4% increase, while top-down analysts projected a 2.7% decline.

- Fed minutes indicate they are not satisfied with the progress on inflation.

- The consensus is that we are headed to recession; Larry Summers and Alan Greenspan both said this past week that a recession is a likely outcome.

- It took 15 rounds of voting to elect Kevin McCarthy as the new speaker of the House. A clear indication of the dysfunction of the Republican party. The Republicans were held hostage by the crazies on the far right. They should have used the opportunity to combine with Democrats and elect a speaker more towards the center of the political spectrum to take power away from the extremes on both sides.

- This election is not good news for negotiations on the debt limit later in the year.

SCOREBOARD

Week Ending 12/30/2022

MARKET RECAP

Stocks closed the year with a slight loss of 0.1%. The overall US stock market returned -19.51% for the year, the S&P 500 was down by -18.17%, international stocks were off by -16.09%, and bonds were down -13.02%.

The Dow did the best, dropping by 8.8%, while the NASDAQ fell by 33.1%. Investors will watch how stocks perform during the first five days of the year. According to the “Stock Trader’s Almanac,” “the last 47 up First Five Days were followed by full-year gains 39 times.” That equates to an 83% accuracy ratio with an average return of 14%.

Analysts did a good job predicting earnings for 2022. According to Bloomberg, the consensus was for $221 per share in S&P 500 adjusted earnings, and right now, it looks like that estimate will close to the target. But they were way off on the price of the index. The forecast was for the S&P 500 to end the year at 4,950, which was way higher than the 3,821.62 closing price. For 2023, the average estimate is 4,078. So you can probably assume that estimate is the one number the index won’t be close to; only seven times in 23 years of data has the forecast been within 5% of the consensus.

Economists expect a recession in 2023.

Q3 GDP was revised up to 3.2% from 2.9%. According to the Case-Shiller index, home prices fell for the fourth straight month, down by 0.3% in October.

SCOREBOARD

Week Ending 12/23/2022

MARKET RECAP

US stocks fell slightly, down 0.17%, while international stocks managed a 0.60% advance. Bonds dropped by 1.39%.

Personal spending was up by 0.1% in November, down from 0.9% in October, indicating a slowdown in consumer spending. At the same time, the personal consumption expenditures price index increased by 5.5% year over year in November, down from 6.1% in October. Month to month, the increase was only 0.1%, compared to 0.4% in October. So, inflation seems to be dropping at a decent pace.

Caroline Ellison and Gary Wang, two senior executives at FTX/Alameda, pleaded guilty to fraud and to cooperate in the government’s investigation. In the meantime, ringleader Bankman-Fried was bailed out of jail on a $ 250 million bond.

SCOREBOARD