HIGHLIGHTS

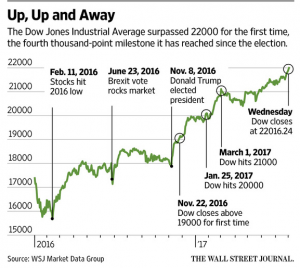

- Market rallies, 4-points off all-time high.

- How this bull market might end.

- Q2 GDP revised up to 3.0%.

- Nonfarm payrolls increase by 150,000, below consensus estimates.

- North Korea sets off a hydrogen bomb.

- Hurricane Harvey lowers the chance of a government shutdown.

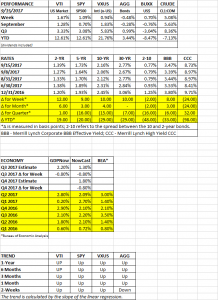

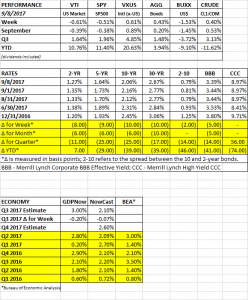

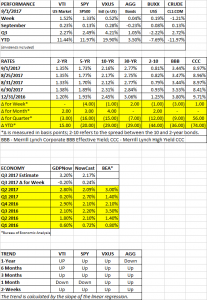

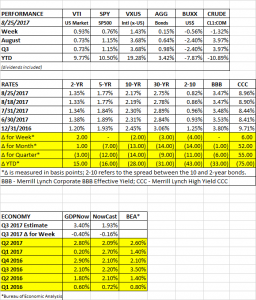

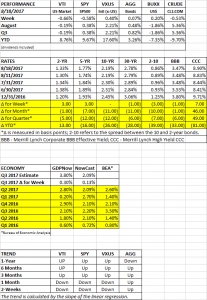

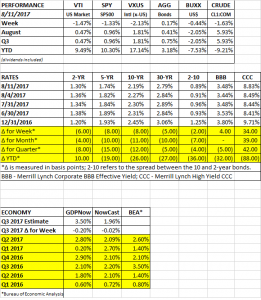

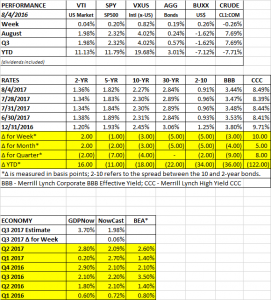

PERFORMANCE

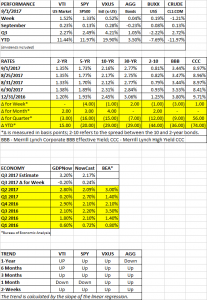

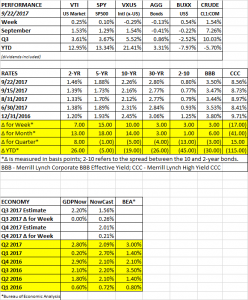

The S&P 500 rallied last week and is now 4.36 points away from its all-time high of 2780.91, set on August 7, 2017. Overall, US equities were up 1.5%, international equities +0.52%, bonds were flat, the dollar was up slightly, +0.19% and crude oil declined by 1.21%.

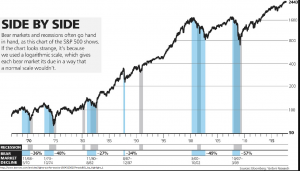

“HOW THIS BULL MARKET WILL END”

That was the cover story in this week’s Barron’s. Barron’s does not think the end of the bull run is imminent. Most bull markets end due to recession, and there is not appear to be one around the corner.

According to Barron’s, there are two conditions that currently exist that increases the odds of a selloff. One is valuation. The forward p/e on the S&P 500 is 17.7, close to the highest since the dot-com era. High valuations have minimal short-term forecasting value, but when bear markets begin, it is usually when the market is in a high valuation zone.

The second condition is rising interest rates. The main risk is if the Fed moves too fast.

Mix in a recession with the above two conditions and then you have the makings of a bear market. Recessions led to the bear markets of 1973-1974, the tech bust and the Great Recession.

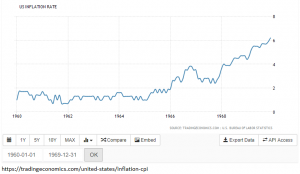

An economy that revs up would be another possible threat. This is what happened before the crash in 1987. The economy began to accelerate, inflation rates and interest rates began to rise. But back then, interest rates on long term treasuries touched 10%, we are nowhere near that now. But if economic growth were to accelerate, given the tight labor market, inflation could suddenly pick up, forcing the Fed to move faster than anticipated, which would increase the chance of error eventually leading to recession.

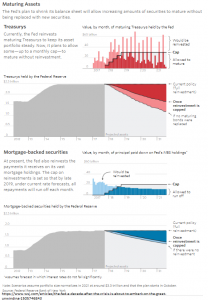

Other potential threats include a hard landing in China, antitrust actions against the FANG stocks, and the shrinking of the Fed’s balance sheet. The shrinking of the balance sheet has never been done to this extent before and it remains to be seen how the markets will react.

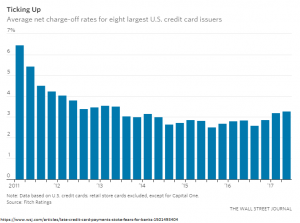

Some warning signs could include widening credit spreads, an inverted yield curve, the closing of the spread between the earnings yield and the 10-year treasury, making bonds more attractive versus stocks, a rise in the unemployment rate and an increase in jobless claims.

Changes in the structure of the market sometimes accelerate a market selloff. In the Panic of 1907, trust companies were new. They weren’t required to hold any cash reserves like banks. Over time, they increased their risky investments and when the economy turned to the downside, it led to a run on the market until JP Morgan led a group of banks to step in and save the day. In the crash of 1987 it was portfolio insurance. Today, more than $2.4 trillion are invested in exchange traded funds. Up from more than $534 billion in 2007. Some argue such a concentration in these passive type funds would accelerate the next downturn as everyone ends up selling the same stocks. Also, today, you have an acceleration in the dominance of algorithms. What happens if the market begins to sell off and all the algorithms begin sending sell signals at the same time?

GDP REVISED UP

GDP growth in Q2 was revised to 3%, up from 2.60%. That was the best second quarter in two years. It remains to be seen whether the economy can sustain that pace. Right now, Q3 growth is estimated at 3.2% by the Atlanta Fed’s GDPNow model. Some factors supporting improved growth include strong economies around the world, a tight labor market and good corporate profits.

The ISM Manufacturing Index increased 2.5 points in August to 58.8. It was the second biggest gain since June of 2013 and the highest level since April of 2011. This would suggest that GDP should be strong (by recent standards) this quarter.

PAYROLL REPORT

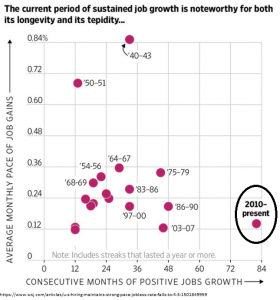

The payroll report came in slightly below consensus. Nonfarm payrolls were up by 156,000, falling short of the consensus estimate of 180,000, and the prior two months were revised lower by 41,000. The increase continues the longest streak ever of increasing payrolls, almost seven years at this point. Normally, August payrolls numbers are revised higher in subsequent months, that has happened in seven of the past eight years.

The unemployment rate increased from 4.3% to 4.4%. Average hourly earnings rose by only 0.1% and the average workweek declined to 34.4 hours from 34.5 hours.

NORTH KOREA

North Korea set off a hydrogen bomb on Sunday, continuing their provocative actions. For the most part, the market has ignored all of this, but this is a geopolitical threat with potentially grave consequences.

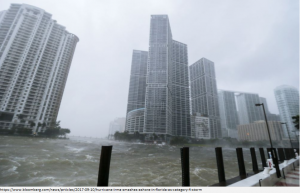

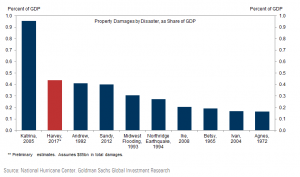

ODDS OF GOVERNMENT SHUTDOWN NOW LOWERED

Hurricane Harvey lowers the chances of a government shutdown. Given the situation in Texas, no one wants to be blamed for sidetracking the government when they need to concentrate on relief efforts. Most likely, relief funding will be coupled with legislation to increase the debt limit.

SCOREBOARD