HIGHLIGHTS

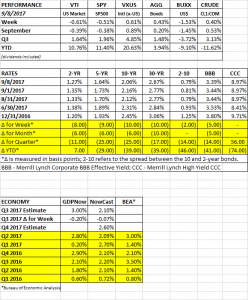

- US equities down 0.61%, international stocks up 0.61%.

- Treasury rates continue to fall.

- US stocks still in a stair-step pattern.

- Debt ceiling and hurricane relief bill passes in bipartisan cooperation.

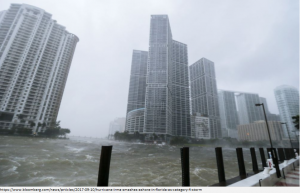

- Hurricane Irma hits Florida hard as we are writing this, Miami Financial District is under water.

- Hurricanes and low inflation might give the Fed pause on raising rates.

- Chinese yuan is on the rise.

- ECB might pullback on stimulus soon.

PERFORMANCE

US equities were down by 0.61%, but international stocks increased by the identical percentage, +0.61. Bonds were up 0.43% as interest rates generally fell by 8 to 10 basis points across the curve. The dollar fell by 1.53% and crude oil was up by 0.40%.

Not much can shake this market. The threat of nuclear war, hurricanes, mayhem in Washington, the market just hangs in there and ignores the news for the most part, continuing to focus on rising earnings and very low interest rates. But while US equities have not fallen, they haven’t risen much either lately. The S&P 500 is priced about the same as it was on July 20th. This is consistent with its pattern over the last year. Trading in a range and the breaking out to a new range in a stair-step fashion. Equities hit new highs, then consolidate and trade within a range, and then break out to another high, and higher-level range.

The market is way overdue for a correction or a pullback of some sort, but this is not news to investors. Maybe the fact that everyone is expecting the pullback is what has been keeping the stair-step pattern intact.

DEBT CEILING/HURRICANE RELIEF

Trump found some new friends in Democrat minority leaders Chuck Schumer in the Senate and Nancy Pelosi in the House, and in quick order, they put together a deal that provides hurricane relief and raises the debt limit through December. We would have preferred a longer-term deal, but are good with Trump making a bipartisan effort on legislation. Maybe that formula can work on other important initiatives down the line and lower the acrimony in Washington.

As we write this week’s column, Hurricane Irma is pounding Florida. While the storm’s center is aimed at the west coast of Florida, initial reports show that the east coast will not be spared. Miami’s financial district on Brickell was a few feet deep in water on Sunday afternoon, only midway through the storm.

Expect billions and billions in damages. The government must step in and help the communities devastated by the hurricanes. But from a bottom line perspective, this continues the pattern of more aid out of Washington, less fiscal discipline, more deficits and a larger intrusion by the government in the economy. With interest rates close to all-time lows, bigger deficits may not be a problem now, but will be at some point in the future when interest rates get to higher levels.

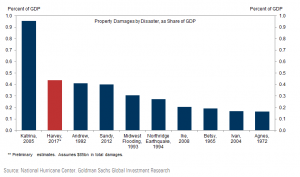

Near term impact of the hurricanes will be a slight increase in inflation (mainly due to higher gasoline prices), slower growth over the next few months (to be offset in the months following), lower employment and higher initial claims for unemployment. Total property losses from Harvey should be in the $70b to $100b range, which would be about 0.5% of GDP. There are no estimates on the damage from Irma yet, but it will be immense.

HURRICANES/LOW INFLATION TO GIVE FED PAUSE

A combination of two monster hurricanes and an inflation rate that won’t budge higher are giving Fed officials pause as to whether to follow through on another interest rate increase this year. Inflation continues in the sub-2% range, short of the Fed’s 2% target. On top of the low inflation, hurricanes Harvey and Irma will likely have a negative impact on GDP growth in Q3 and Q4, although that will be offset later. Ironically, the dual hurricanes might increase inflation in the longer run as the shortage of construction workers becomes more severe, pushing wages higher as employers compete for workers.

YUAN ON THE RISE

In another example of the markets moving in the opposite of consensus, the Chinese yuan hit a 16-month high this week. It is now up 7% versus the dollar for 2017, and has made up all its 2016 decline. A combination of a weak dollar and currency controls by the Chinese central bank have given a lift to the yuan. Currency reserves are now up for the 7th straight month to $3.092 trillion. The higher yuan has dampened demand for Chinese products overseas. Year-over-year growth in sales to the US from China were down 8.5% in July.

ECB

The European Central Bank indicated it is getting closer to putting the brakes on its expansive monetary policy, but will wait a little longer before taking action. President Mario Draghi said he will probably announce at its October meeting some details of changes it plans to implement.

SCOREBOARD