HIGHLIGHTS

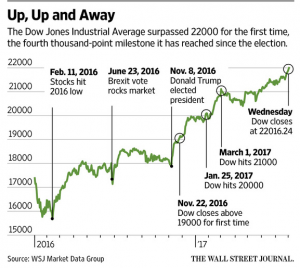

- The Dow Jones Industrial Average sets another record, breaking 22,000.

- Broader indexes are flat, transports are down.

- Solid payroll report

- Late credit card payments increase

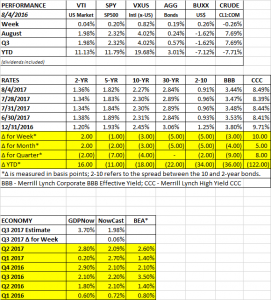

PERFORMANCE

The Dow broke through another milestone, cracking the 22,000 barrier and ending the week at 22,092.81, plus 1.20% for the week. However, the broader indexes were closer to flat. The SP500 was up 0.19% and the Nasdaq Composite fell 0.36%. International equities rose by 0.82%.

After peaking on July 14, transport stocks have been down. The IShares Dow Jones Transportation Average Index Fund (IYT) has fallen by 4.78% while the Dow (DIA) has increased by about 1.99% during that time. A divergence between the two signifies a market warning based on the 117-year-old Dow Theory. The Dow Theory states that a rally in an index like the Dow should be confirmed by a rally in the transports (the Rails back in 1900). Times have changed since then and there have been several times in this market rally over the last few years where we did not get this confirmation, but it is worth a mention.

Bonds were up by 0.19% as the treasury yield curve going out from five years fell a few basis points.

ECONOMY

The first look at Q3 growth from the Atlanta Fed’s GDPNow model came in at a strong 4.0%. However, by week end it had dropped to 3.70%. The New York Fed’s Nowcast has Q3 growth at a much milder 1.98%.

SOLID PAYROLL REPORT

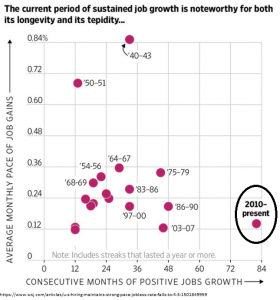

Non-farm payrolls increased by 209,000 in July, higher than the consensus estimate of 180,000. It was the 82nd straight month of job creation, the longest such streak ever. As shown in the chart below, this expansion has been noteworthy for a slow but very steady and long pace.

The May and June non-farm payroll numbers were also revised higher. The unemployment rate fell to 4.3% from 4.4%, the lowest number in 16 years. The labor force increased to 62.9%, up 0.1%. Average hourly earnings were up 2.5% year over year. Almost half of the gains were in bars and restaurants, and healthcare.

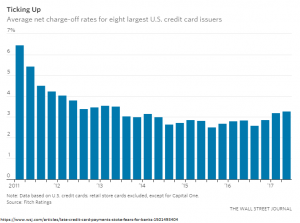

LATE CREDIT CARD PAYMENTS

Credit-card issuers are starting to have collection problems. The average net-charge off for large US card issuers increased to 3.29%, the highest level in four years. Losses are still low based on historical levels. Around 2014 banks started relaxing underwriting standards, which led to a big increase in credit-card spending. That might have led to the higher charge-offs now.

SCOREBOARD