HIGHLIGHTS

- Equities fall around the world.

- Consensus shifting to the view that a pullback is on the way.

- Market falls by more than 1% for the first time in 58 sessions.

- Coming into a rough time of the year.

- Madman theory.

- Lots of positives still in place.

MARKET RECAP – UP OR DOWN?

The long overdue pullback/correction may be on the way. It has now been 410 days since the market fell by at least 5%, the longest such streak since at least 1995. And it seems like the market consensus is shifting to the view that now might be the time for this long overdue pullback. Or then again, maybe it is not.

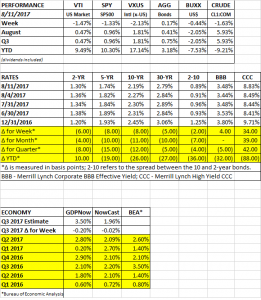

The S&P 500 slipped 1.4% on the week, which was better than international equities, which dropped 2.1%. The S&P is down only 1.6% from its recent high, but underneath the surface the damage has been greater. On Thursday, the market fell by more than 1% for the first time in 58 sessions. The Russell 2000 which tracks small-cap stocks is down 5.2%. The declining dollar is also a problem. While it bumps up US earnings and that helps the market. An offset is the huge amount of investments held in the US by foreign governments and institutions. A declining dollar, coupled with a possible market pullback, could lead to a lower allocation to US assets which would drop equity prices further.

Another issue is the calendar, August, September and October have sometimes been rough months for the market. But it is not only the “months” that might give one worry, the Leuthold Group has pointed out that years that end in the number “7”, dating back to 1887, have produced a drop during this time of year. We had the market crash, down 22%, in October of 1987. In 1997, we had the Asian currency crisis and hints of the forthcoming financial crisis started to appear around this time in 2007. Each of the above was set off by a financial or monetary event. Although the Fed is in tightening mode, their extra cautious pace would not indicate a crisis in the near term. However, the Fed does plan to begin unwinding their balance sheet sometime soon, a process that really has never happened before, at least to this extent. The process will be gradual but it remains to be seen how the market will react when it starts. But maybe the biggest threat to this market might be a geopolitical event like North Korea.

President Trump could not hold back from the continuous prodding by North Korean leader Kim Joung-un and said clearly several times that North Korea better watch its step. The words he used to kick off the verbal storm were that the North Koreans would be “met with fire and fury like the world has never seen.” He told the Koreans to back down on their threats and actions, which of course, they refused to do and responded in like kind. Given that North Korea has threatened the use of nuclear weapons at various points, “fire and fury” might not be the best choice of language. But that seems to be what Trump intended.

Trump might be using a form of what was called in the 1970s the Madman Theory. Basically, the idea is that Trump wants North Korea to think he is crazy enough to engage in an all-out war or even a nuclear war. Of course, the worry for many is that no one really needs any convincing, Trump’s previous actions have already convinced many that he is somewhat unstable. On the assumption that the North Korean leader were to be convinced that indeed Trump is crazy enough to engage in a war, Joung-un would back down. Which North Korea hasn’t done. The Madman Theory only works when you have two rational actors, not two irrational ones.

A complicating factor is China. China holds the most leverage over North Korea, and is the one country that can influence North Korean policy. Now, while at the same time asking for Chinese help, Trump is about to begin investigating China for trade violations. Specifically, intellectual property violations.

There is also the threat of a government shutdown in late September or early October as Congress needs to reauthorize the debt ceiling. Getting Congress to agree on anything has been close to impossible.

Those are all the reasons why the market might fall. On the positive side, the market still has solid momentum, corporate earnings have been strong and the falling dollar adds to that. About 90% of companies have now reported Q2 earnings and earnings are up more than 10% over last year, according to FactSet. There is a chance for corporate tax reform which would give another boost to earnings. Economies around the world are in expansion mode and the US economy continues in its slow and steady growth mode, around 2%. The job market is very strong. And interest rates are so low they provide an economic justification for higher equity valuations.