HIGHLIGHTS

- Stocks fall for the week.

- Treasury yields continue to fall, 30-year is at an all-time low.

- Good economic news.

- Gold is racing higher.

- Apple warns due to coronavirus.

- Japan faces risk of recession.

- Bernie marches on.

MARKET RECAP

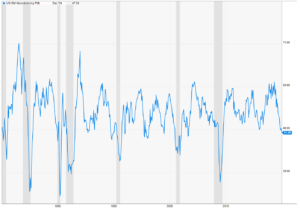

Stocks fell for the week by 1.05% in the US and 1.48% x-US. Bonds rallied by 0.53% as treasury yields continue to fall. The 30-year Treasury yield closed the week at 1.90%, an all-time low. The 10-year yield closed at 1.46%, the lowest level since 2016. The 3-month, at 1.56%, yields more than the 10-year indicating an inverted yield curve, a signal for a possible recession.

ECONOMIC NEWS

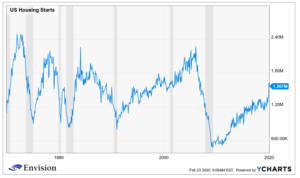

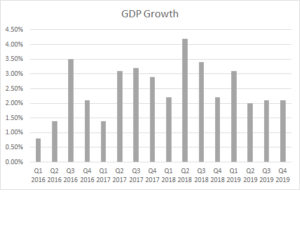

But economic news was for the most part positive. Housing starts and building permits were strong, beating expectations by more than 100,000. Regional Fed reports from New York and Philadelphia were also strong. The Atlanta Fed’s GDPNow model increased estimated Q1 growth from 2.40% to 2.60% and the NY Fed’s Nowcast was increased from 1.39% to 2.01%.

GOLD

But gold is racing higher and is now at its highest point since February of 2013. Indicating worries about economic growth and exploding deficits around the world.

APPLE/CORONAVIRUS

Apple announced on Monday that it won’t hit its projected revenue targets for the current quarter due to the impact of the coronavirus. Apple did not quantify the impact of the virus, saying it was too early. But Apple will be the first of many to announce lower earnings and sales as a result of the virus. There is hope that the spread of the virus is starting to slow, the trend is now lower on both a linear and exponential basis, indicating, that if reports are accurate, the virus might be getting under control.

JAPAN

Japan faces the risk of a recession. The country took an initial hit in the last quarter as the economy contracted at a 6.3% annualized rate due to a 10% rise in the national sales tax on October 1. Now, the coronavirus is hurting tourism and manufacturing.

BERNIE

Bernie Sanders won the Nevada caucuses cementing his lead for the Democratic nomination. A poor performance by Mike Bloomberg at the debates this week dropped hopes of a moderate nominee. For now, and it is early, it looks like a Sanders-Trump matchup. The market is counting on a Trump victory but nobody knows what will happen. But Trump is cheering Bernie on (and trying to stir up some trouble), writing on Twitter, “Looks like Crazy Bernie is doing well in the Great State of Nevada…Congratulations Bernie, & don’t let them take it away from you!”

SCOREBOARD