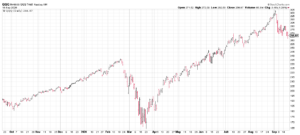

MARKET RECAP

US stocks were down by 1.22% while international equities finished 0.91% higher. Good news from Moderna was offset when the Treasury Department announced it would not continue five special lending facilities, as well as a JP Morgan projection that it sees the economy contracting in Q1 of 2021. Fed Chair Jerome Powell said the next few months will be challenging and asked for more fiscal support, but that does not seem likely until the Biden administration takes power.

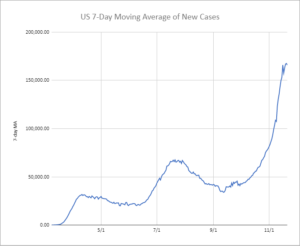

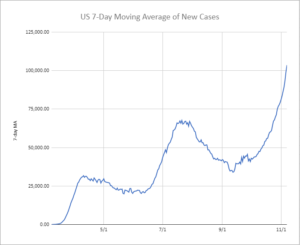

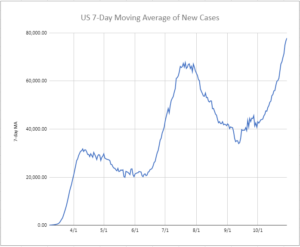

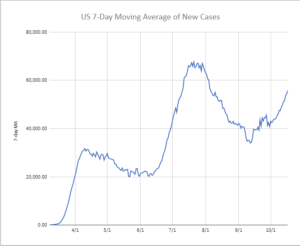

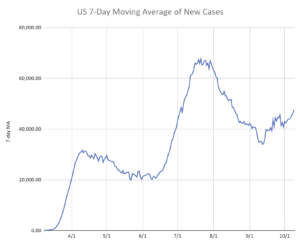

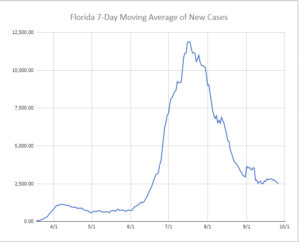

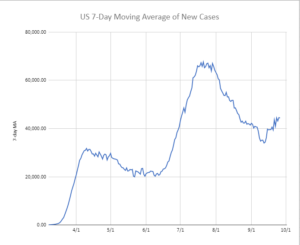

Following up on the Pfizer announcement from one week prior, Moderna announced on Monday that its Covid vaccine is 95% effective based on early trials. That is a huge win for science and puts a rough end date on the epidemic of 9-months to a year, but in the meantime, the virus is just exploding. Maybe, hopefully, the growth of the virus is beginning to slow in the USA, the 7-day moving average has stayed at about 165,000 for five days. Of course, it might just be a pause but the trend has been relentlessly higher since the beginning of October until now.

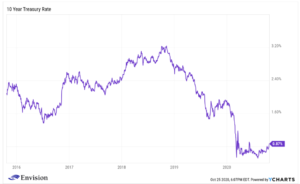

Home sales hit a 14-year high in October as sales increased for the fifth straight month. After years of disappointments, home sales have been the bright spot in the Covid economy, as ultra-low interest rates and a desire to get into individual homes have driven purchases.

October retail sales were disappointing, rising just 0.3% in October, lower than the 0.5% consensus estimate. Jobless claims increased by 32,000 last week. 742,000 were filed last week. More increases might be on the way as Boeing, Disney, and Exxon have recently announced job cuts.

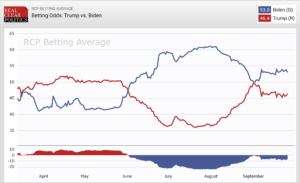

Running out of legal options, Trump’s lawyers are making even more bizarre allegations, claiming the election was stolen via a massive conspiracy involving Democrats and foreign governments, including some help from Hugo Chavez who died in 2013! To date, there is no evidence of any kind of widespread fraud, and many of Trump’s lawyers have said they do not believe there was widespread fraud. Trump fired the official who was in charge of election integrity after he said there was no fraud. Jeffrey Engel, a presidential historian at Southern Methodist University said that other candidates have challenged election results in the past when there were clear and legitimate circumstances, but “all of them recognized that the unity of the country was more important.”

SCOREBOARD