HIGHLIGHTS

- Biden will be the next President although Trump does not concede defeat.

- The Blue Wave does not happen.

- The market likes the mix of power.

- US stocks up by 7.35% in the biggest election week rally since 1932.

- The economic rebound continues but the virus numbers continue to soar.

- Negative-yielding debt hits a record $17.05 trillion.

MARKET RECAP

The market was anticipating a Biden romp, a blue wave, and a huge fiscal package that would offset higher tax rates. Investors figured that was a good formula and stocks ran up in anticipation. What they got might even be better. Biden will be the President, a Senate that might lean Republican, and the Republicans even managed to pick up seats in the House. What it all means is the US gets a civil, decent, and more predictable President, someone that will act as a unifier and a leader for all, and that will be restrained from doing anything too crazy given the mix of the Senate. The market liked the look of that and turned in its best week since April, up 7.35%, it was the best election week return since 1932, and that was coming off the worst pre-election week ever.

Of course, Trump refused to concede defeat, embarrassing himself in the process, claiming the votes that put Biden over the top were illegitimate and filing lawsuits wherever possible. But no one is buying it, Biden will be the next President after the lawsuits run their course.

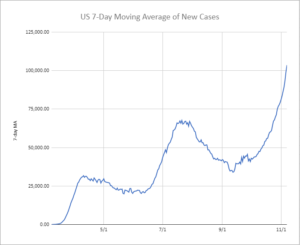

While the political news was good, the virus news wasn’t. The virus is taking on an exponential growth rate and that is bound to impact the economy until it gets under control.

In the meantime, the economy continues to rebound. The Institute for Supply Management’s manufacturing index increased to its highest level, 59.3, since 2018. New orders reached its highest point in 17 years. The October payroll report was also strong, as the US added 638,000 new jobs and the unemployment rate fell to 6.9%.

Stocks are getting support from interest rates that basically don’t exist, at least above zero. Bloomberg reported that negative-yielding debt hit $17.05 trillion on Friday, surpassing the August 2019 mark. On top of that, the Fed is buying $120 billion per month in treasuries and agency mortgage-backed securities each month. The Fed’s balance sheet has ballooned to $7.1 trillion from $4.1 trillion at the end of February. And as we have shown in the past and below, there is a strong correlation between Fed assets and the stock market.

More than 25% of all investment-grade debt now yields less than zero. That has pushed investors into equities as well as riskier fixed-income investments like high-yield and leveraged loans. While the price of the riskier fixed-income products has risen, the fundamentals haven’t. The artificially low investment-grade yields are masking potential problems in these debt markets. A problem maybe not for now but probably for later.

SCOREBOARD