A Vanguard video showing the impact of the Presidential election on the market. The answer…not much.

A Vanguard video showing the impact of the Presidential election on the market. The answer…not much.

Here is a series of Ben Graham articles he wrote in 1932 for Forbes Magazine:

PERFORMANCE

Equity and fixed income markets were down on the week. US markets fell by about 1% and international markets by about 1.50%. Bonds declined by 0.19%, as the longer end of the curve got steeper.

Earnings season got off to a poor start on disappointing earnings by Alcoa. SP500 earnings have declined for five quarters in a row, and the expectation is for a small decline for Q3. However, normally earnings come in a little bit above expectations, so there is hope that the earnings slide might end.

A rising dollar (+1.38% for the week) also has not helped. That would cut into US exports and lower earnings from overseas, impacting US large-caps. The British pound fell by 2.17% as Brexit becomes closer to reality. A lot of the increase in the dollar was due to the fall of the Pound.

The political environment certainly has not done anything to help improve long term confidence in the US economy, unless one considers that Trump’s chances to win seem to have fallen. Not that the alternative is much better.

Technically, the market is starting to roll over from positive to negative. The chart below shows the price action of the US total stock market as measured by the VTI ETF. Prices are shown in white. The colored lines measure a linear regression for different lengths of time. When the regression line is moving higher, the trend is up for the given period. Likewise, when the regression line is moving down, so is the trend. For periods of 5-days (red), 21-days (yellow) and 63-days (green) the trend is down. For the two longer periods, 126-days (purple) and 252-days (blue), the trend is still up. This does not necessarily mean that the prices will continue down, but it is a different way to see that the market has lost its short-term positive momentum.

ECONOMY/GDP

The Atlanta Fed’s GDP forecast for Q3 growth continued to fall. It has pretty much been one-way down since the original forecast in late July (see below). The estimate is now at 1.90%, which is down from 2.10% last week. The decline was impacted by a lower estimate of personal consumption expenditures.

The NY Fed’s Nowcast estimate for Q3 increased to 2.3% from 2.2% last week. The Q4 estimate increased to 1.6% from 1.3%. Higher than expected retail sales helped push the estimates higher.

Our politicians would have you believe that immigration is bad for the economy. Philly Fed President Patrick Harker sets the record straight in this speech.

PERFORMANCE

Both US and international equity markets were down about 0.70% for the week. The market is starting to think about a possible December rate increase. The yields on the 5 and 10-year note shot higher by 12 and 13 basis points. That caused interest rate sensitive assets like REITs and utilities to sell off. REITs were down about 5.3% and utilities dropped 3.8%. On the flip side, banks, which would benefit from higher rates, increased by about 2.5%.

The SPY (SP500 ETF) has now been trading in a tight range between 212 and 219.5 since July 7. The range has gotten even tighter over the last few weeks and could break out one way or the other any day now.

ECONOMY

The Atlanta Fed’s GDPNow forecast for Q3 growth fell to 2.1%, down from 2.4% last week. The fall was due to lower inventory investment and slower government spending growth. The NY Fed’s NowCast for Q3 remain unchanged at 2.2%. The Q4 estimate increased by 0.1% to 1.3% due to strong ISM reports and international trade data.

The Institute for Supply Management’s (ISM) Non-Manufacturing report for September was extremely strong. The reading came in at 57.1 versus 51.4 for August. Above 50 is considered expansionary. It was the largest one month increase in the history of the survey. Combined with the manufacturing survey, and adjusting for the respective weights in the economy, the ISM increased to 56.5 compared to 51.2, also the largest increase on record.

Employers added 156k job in September. The number of jobs added was slightly below the consensus, but it is still a solid number. Until the economy picks up steam and corporate earnings begin to rebound, private sector job growth is likely to remain more subdued than it has been over the last couple of years. The unemployment rate ticked up by 0.1% to 5.0% but that was due to an increase in the number of people now looking for work.

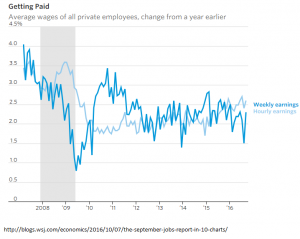

Measures of weekly earnings and hourly earnings both improved year over year.

PERFORMANCE

Markets were mostly flat. US equity markets were up about 0.15% for the week. International markets were down very slightly (-0.06%), bonds up 0.17% and the US dollar was down 0.05%. Crude was the big winner, +6.84%, on news that OPEC and reached an agreement to limit production.

Deutsche Bank frightened the market for most of the week. The US Justice Department made it known in mid-September that it would seek a $14b penalty for mortgage problems prior to the great recession. That number was big enough to get investors thinking about the survival chances for Deutsche. Inevitably, that led to the beginnings of a run on the bank, as some hedge funds pulled money from the bank (its also possible some of these funds were short the stock at the same time). The shares tumbled and brought the market down with it. But on Friday, news was out that the penalty number would be much lower. Shares rallied 14% on the day, and led the market higher.

GDP

The Atlanta Fed’s GDPNow model took another big hit on their forecast for Q3 growth. The estimate fell by 0.4% to 2.4%. The model had fallen by 1/2% the week prior. The decline was caused by a lower estimate for consumer spending growth and by a lower contribution from inventory investment. The NY Fed’s Nowcast fell by 0.1% to 2.2% for Q3. Q4 remained steady at 1.2%. The Nowcast was negatively impacted by personal consumption expenditures and sales of single family homes, but was helped by durable goods orders and wholesale inventory data.

PERFORMANCE

The Fed did not lift rates this week and that moved the markets higher. The US equity markets were up 1.40% and international markets were up 2.90%. The US dollar declined 0.72% and oil rallied by 4.28%. The Fed made it clear that the pace of interest rate increases would be very deliberate and carefully considered. That helped bonds, which rallied by 0.38%. However, the Fed is probably leaning towards a December increase. Assuming nothing crazy with the economy between now and then, we believe a slow and measured pace of interest rate increases would be beneficial for the economy in order to put it back into a historical balance.

ECONOMY

The Atlanta Fed’s GDPNow declined to 2.90% from 3.0% due to a drop on the forecast for third-quarter real consumer spending growth ticked down by 0.10%.The NY Fed’s Nowcast forecasts took a big hit. Both Q3 and Q4 declined by 1/2% to 2.30% and 1.20%, respectively. The largest negative contributions came from manufacturing, retail sales, and housing and construction data.

Initial claims for unemployment fell by 8k to 252k. It was one of the lowest numbers since 1973 and indicates a tightening labor market.

EARNINGS RECESSION CONTINUES

According to FactSet, earnings will decline for the sixth straight quarter, the longest streak since 2008. The losing streak was expected to end this quarter but that likely won’t happen. Analysts now expect earnings to finally improve in Q4.

FISCAL STIMULAS WORLDWIDE

There seems to be a worldwide movement beginning to utilize fiscal stimulus to get economies moving. Canadian Prime Minister Justin Trudeau has a $46b 10-year infrastructure plan. Japan has a $45b plan. There is similar talk elsewhere around the world and both Clinton and Trump favor new fiscal stimulus. The consequences are unknown, but someone will have to pay or finance this spending. In the US, higher inflation and a lower dollar might result, but the plan could put an end the earnings recession cited above.

PERFORMANCE

US equity markets were about even on the week. International was down 2.22%, bonds were down 0.45%, the dollar was up 0.72% and crude took a big hit, down 5.30%.

The markets have been on an up and down ride recently. A week ago Friday, on fear of higher interest rates, the SPY (SP500 ETF) fell 2.4%. Another Fed official said on Monday that rates were probably not going anywhere in September, so the market rallied 1.44%, only to fall another 1.44% on Tuesday. Wednesday was down slightly, but on Thursday the market went up by almost 1%, and then fell on Friday to end the week just about even. For now, the SPY has found a floor in the 212.30 area. The Fed meets on Tuesday and Wednesday and you can be assured that will be closely watched.

TREASURY RATES

For the month, treasury rates have been flat at the short-end but have increased by 12 basis points on the 10-year and 21 basis points on the 30-year, indicating a steeper yield curve. The same has been true around the world. Usually, a steepening curve is indicative of a growing economy, higher inflation or more aggressive central bank action. The market might be pricing in much higher deficits due to a large dose of fiscal stimulus under the new administration (no matter Trump or Clinton).

A steepening yield curve often will lead to lower returns for “bond proxies” like utilities and REITS and higher returns for banks. A few weeks is not a long-term trend, but it is something to watch.

GDP/ECONOMY

The Atlanta Fed’s GDPNow estimates Q3 growth at 3.0%. That is down from 3.3% last week. The drop was due to a decline in the estimate for real consumer spending growth and real government spending growth for Q3. The NY Fed NowCast remained unchanged at 2.8%.

Jobless claims continued at their remarkably low rate, coming in at 260k for the week. Retail sales fell 0.3% in August. It was the first decline in six months. Year over year retail sales are up 2.4%.

Core CPI was up 0.3%, the most in six months, driven by higher shelter and health care costs. Year over year, CPI was up 1.1% but that is up from 0.8% last month. Core CPI was up 2.3% year over year, the biggest increase since September of 2008.

ODDS OF A TRUMP WIN

The odds continue to increase for a Trump win in November. As the odds increase, so does the level of economic uncertainty and markets do not like uncertainty. No matter your belief on if Trump will be good or bad, his proposed policies definitely increase the uncertainty level for the economy and that is probably being reflected in recent market volatility. The latest Betfair numbers put the odds of a Trump win at about 34%.

PERFORMANCE

Equity markets in the US fell about 2.35% with most of the damage coming on Friday. The previous Friday the market rallied on a weaker payroll hiring number, which the market figured was good news in the sense that it might delay an interest rate hike. This Friday, the market fell hard when Boston Fed President Eric Rosengreen said that there is a “reasonable case” for a gradual rise in interest rates. A nuclear test in North Korea didn’t help. In addition, the European Central Bank declined to add more stimulus to the system.

The selloff is still minor at this point but there might be more. Two weeks back we wrote that “a prolonged period of low volatility, a negative divergence of price performance versus technical indicators, price action that is slowly rolling over, and a calendar period that sometimes, historically, has been unkind to stocks, might be a hint that these is a possibility of a small to modest sell off here.” There are some analysts calling for a more severe sell off.

With the election getting closer and the race apparently getting tighter, that is another reason for more volatility in the market.

Treasury rates did increase last week, but they barely moved on the short end of the curve and increased more on the long end of the curve. The curve got steeper, which is usually more indicative of a healthy economy, not one bordering on recession.

GDP

The Atlanta Fed’s GDPNow estimate for Q3 growth declined to 3.3% from 3.5%. Lower forecasts for real consumer spending and real equipment investment growth helped drive the estimate lower. The NY Fed’s NowCast Q3 estimate remained steady at 2.8%, but the Q4 estimate declined to 1.70% from 2.0%.

ECONOMIC GROWTH BACK TO STALL SPEED AGAIN?

For a while it seemed like the US economy was getting some liftoff in Q3, but recent reports in the last week or so are now showing slowing growth. The Institute for Supply Management reports for both manufacturing and non-manufacturing declined last month. The non-manufacturing number fell to 51.4 in August from 55.5 in July. Economists were expecting 54.9. The manufacturing number fell to 49.4. Above 50 is considered expansionary, below 50 is contractionary. Given that the US economy is primarily non-manufacturing based, net-net, the numbers point to very slow growth.

Payroll reports continue strong. Initial jobless claims fell by 4k to 259k. The four week average of 261k is lower than the 12-month average of 268k. A year ago the average was 277k.

As shown further above, the current GDP estimates for Q3 and Q4 are showing higher growth in the back half of the year as compared to the first half.