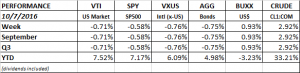

PERFORMANCE

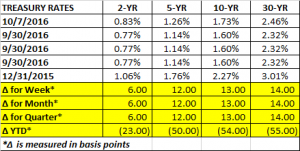

Both US and international equity markets were down about 0.70% for the week. The market is starting to think about a possible December rate increase. The yields on the 5 and 10-year note shot higher by 12 and 13 basis points. That caused interest rate sensitive assets like REITs and utilities to sell off. REITs were down about 5.3% and utilities dropped 3.8%. On the flip side, banks, which would benefit from higher rates, increased by about 2.5%.

The SPY (SP500 ETF) has now been trading in a tight range between 212 and 219.5 since July 7. The range has gotten even tighter over the last few weeks and could break out one way or the other any day now.

ECONOMY

The Atlanta Fed’s GDPNow forecast for Q3 growth fell to 2.1%, down from 2.4% last week. The fall was due to lower inventory investment and slower government spending growth. The NY Fed’s NowCast for Q3 remain unchanged at 2.2%. The Q4 estimate increased by 0.1% to 1.3% due to strong ISM reports and international trade data.

The Institute for Supply Management’s (ISM) Non-Manufacturing report for September was extremely strong. The reading came in at 57.1 versus 51.4 for August. Above 50 is considered expansionary. It was the largest one month increase in the history of the survey. Combined with the manufacturing survey, and adjusting for the respective weights in the economy, the ISM increased to 56.5 compared to 51.2, also the largest increase on record.

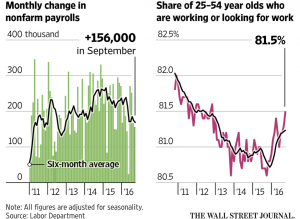

Employers added 156k job in September. The number of jobs added was slightly below the consensus, but it is still a solid number. Until the economy picks up steam and corporate earnings begin to rebound, private sector job growth is likely to remain more subdued than it has been over the last couple of years. The unemployment rate ticked up by 0.1% to 5.0% but that was due to an increase in the number of people now looking for work.

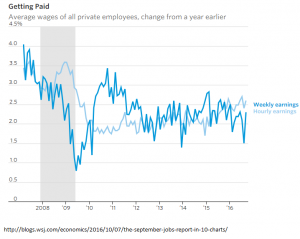

Measures of weekly earnings and hourly earnings both improved year over year.