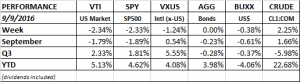

PERFORMANCE

Equity markets in the US fell about 2.35% with most of the damage coming on Friday. The previous Friday the market rallied on a weaker payroll hiring number, which the market figured was good news in the sense that it might delay an interest rate hike. This Friday, the market fell hard when Boston Fed President Eric Rosengreen said that there is a “reasonable case” for a gradual rise in interest rates. A nuclear test in North Korea didn’t help. In addition, the European Central Bank declined to add more stimulus to the system.

The selloff is still minor at this point but there might be more. Two weeks back we wrote that “a prolonged period of low volatility, a negative divergence of price performance versus technical indicators, price action that is slowly rolling over, and a calendar period that sometimes, historically, has been unkind to stocks, might be a hint that these is a possibility of a small to modest sell off here.” There are some analysts calling for a more severe sell off.

With the election getting closer and the race apparently getting tighter, that is another reason for more volatility in the market.

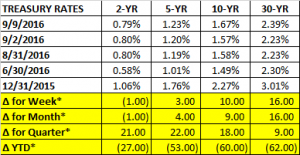

Treasury rates did increase last week, but they barely moved on the short end of the curve and increased more on the long end of the curve. The curve got steeper, which is usually more indicative of a healthy economy, not one bordering on recession.

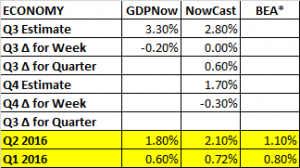

GDP

The Atlanta Fed’s GDPNow estimate for Q3 growth declined to 3.3% from 3.5%. Lower forecasts for real consumer spending and real equipment investment growth helped drive the estimate lower. The NY Fed’s NowCast Q3 estimate remained steady at 2.8%, but the Q4 estimate declined to 1.70% from 2.0%.

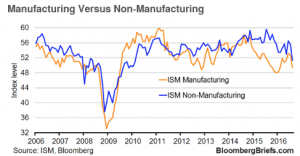

ECONOMIC GROWTH BACK TO STALL SPEED AGAIN?

For a while it seemed like the US economy was getting some liftoff in Q3, but recent reports in the last week or so are now showing slowing growth. The Institute for Supply Management reports for both manufacturing and non-manufacturing declined last month. The non-manufacturing number fell to 51.4 in August from 55.5 in July. Economists were expecting 54.9. The manufacturing number fell to 49.4. Above 50 is considered expansionary, below 50 is contractionary. Given that the US economy is primarily non-manufacturing based, net-net, the numbers point to very slow growth.

Payroll reports continue strong. Initial jobless claims fell by 4k to 259k. The four week average of 261k is lower than the 12-month average of 268k. A year ago the average was 277k.

As shown further above, the current GDP estimates for Q3 and Q4 are showing higher growth in the back half of the year as compared to the first half.