PERFORMANCE

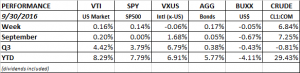

Markets were mostly flat. US equity markets were up about 0.15% for the week. International markets were down very slightly (-0.06%), bonds up 0.17% and the US dollar was down 0.05%. Crude was the big winner, +6.84%, on news that OPEC and reached an agreement to limit production.

Deutsche Bank frightened the market for most of the week. The US Justice Department made it known in mid-September that it would seek a $14b penalty for mortgage problems prior to the great recession. That number was big enough to get investors thinking about the survival chances for Deutsche. Inevitably, that led to the beginnings of a run on the bank, as some hedge funds pulled money from the bank (its also possible some of these funds were short the stock at the same time). The shares tumbled and brought the market down with it. But on Friday, news was out that the penalty number would be much lower. Shares rallied 14% on the day, and led the market higher.

GDP

The Atlanta Fed’s GDPNow model took another big hit on their forecast for Q3 growth. The estimate fell by 0.4% to 2.4%. The model had fallen by 1/2% the week prior. The decline was caused by a lower estimate for consumer spending growth and by a lower contribution from inventory investment. The NY Fed’s Nowcast fell by 0.1% to 2.2% for Q3. Q4 remained steady at 1.2%. The Nowcast was negatively impacted by personal consumption expenditures and sales of single family homes, but was helped by durable goods orders and wholesale inventory data.